The Wall Street Journal (“WSJ”) reported on July 18th, 2021 that the U.S. economy’s 2021 growth surge likely peaked in the spring, according to economists surveyed who expect to see slower, but still strong expansion into 2022. WSJ surveyed economists this month on expectations for economic growth – here is an overview of the findings:

- The factors that impacted rapid gains in consumer spending, such as business re-openings, rising vaccination rates, and an infusion of government pandemic aid are starting to subside.

- Economists expect solid growth into the coming year largely driven by job gains, deployment of pent-up savings, and continued government fiscal support.

- On average, economists surveyed anticipate the economy expanded at a 9.1% seasonally adjusted annual rate from April-June. If that holds true it would be the second fastest pace since 1983, exceeded only by last summer’s rebound when the initial pandemic restrictions started to ease.

- The economy is expected to grow 6.9% this year (measured from the 4th quarter of last year to the same period in 2021). Growth for 2022 is forecasted for 3.2% and then 2.3% in 2023.

- Labor market challenges persist as the economy is still 7 million jobs short of pre-pandemic levels.

- Moderate economic growth could ease job gains and inflation. Inflation measured by the Labor Department’s consumer price index is anticipated to decline to 4.1% in December from a year earlier, and 2.5% by the end of 2022. For context, consumer prices rose 5.4% in June this year from a year before, the most since 2008.

Inflation Remains a Hot Topic

While opinions vary on the lingering risks of inflation, there is an overwhelming consensus that inflation remains a hot topic for companies and the Federal Reserve. Bloomberg reported inflation was mentioned on 87% of earnings conference calls by S&P companies this month, compared with 33% a year ago, reflecting a concern about companies’ ability to pass on costs to consumers.

In congressional testimony last week, Federal Reserve Chairman Jerome Powell stated the Fed will not hesitate to raise interest rates to keep inflation under control, but said he expects price pressures to ease later this year. He attributes higher than expected inflation to a “perfect storm” of high demand and low supply, fueled by supply chain bottlenecks. The Federal Reserve is expected to keep interest rates near zero until it is confident inflation will hold at its 2% target and the labor market returns to maximum employment. Chairman Powell reiterated the economy is a ways off from reaching its employment goals. Although last week, initial claims for unemployment insurance fell to a pandemic-era low of 360,000, the best number since March 14, 2020.

The Federal Reserve’s current policy guidance for inflation was released in August 2020, which largely speaks to a 2% inflation target. The recent inflation surge fueled by pandemic-related and other factors has resulted in an unanticipated problem with implementation of this policy prerogative.

Chairman Powell stated he expects inflation pressure to recede, but the question remains how far inflation will fall and where it settles over time compared to the 2% goal? The Federal Reserve released a monetary policy report in early July, stating officials might be growing less confident about labor market conditions returning to pre-pandemic levels without the possibility of accepting higher inflation.

Consumer Sentiment Also Drops

The University of Michigan’s index of consumer sentiment unexpectedly fell to 80.8 in the first half of July from 85.5 in June, marking the index’s lowest level since February. Economists polled by Reuters had forecast the index would rise to 86.5.

Consumers surveyed expect a 4.8% increase in the cost of living this year, the highest level since 2008. While consumer sentiment is higher now than during the worst months of the pandemic, sentiment remains depressed compared to pre-pandemic levels. Particularly noteworthy are concerns about rising prices on homes, vehicles, and household durables.

Municipal Bond Yields Decline

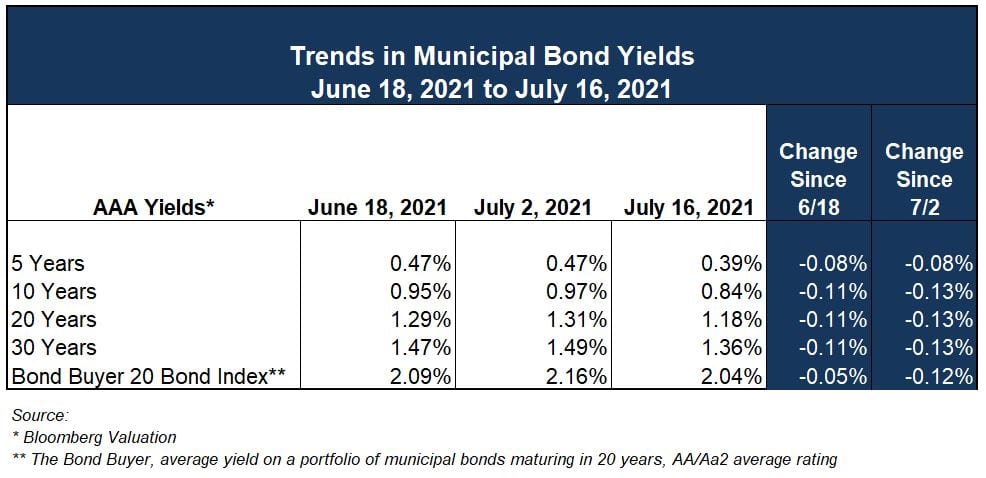

The imbalance of municipal bond supply and demand discussed in our last Commentary persists. In the week ended July 14th, Refinitiv Lipper reported tax-exempt mutual funds saw $2.238 billion of inflows. This marks the nineteenth consecutive week of inflows and the fifth over $2 billion. Municipal bond yields declined across the curve over the past two weeks. The yield curve continues to flatten, as intermediate and long-term yields decline more than shorter yields. Overall conditions remain favorable for issuers.

Municipal yields have followed U.S. Treasury rates lower since last week. The benchmark 10-year reached a recent high of roughly 1.75% in March and has steadily declined to around 1.30% the week of July 12th, and as low as 1.15% intraday on Tuesday July 20th. Markets were skittish on the growing emergence of the “Delta” COVID-19 variant and the potential impact on the U.S. and global economies, just as we emerge from pandemic-mandates and restrictions. Equity markets were down handily the day prior, with the safety of U.S. Treasuries seen as a benefit, even with negative real yields (accounting for inflation).

Required Disclosures: Please Read

Ehlers is the joint marketing name of the following affiliated businesses (collectively, the “Affiliates”): Ehlers & Associates, Inc. (“EA”), a municipal advisor registered with the Municipal Securities Rulemaking Board (“MSRB”) and the Securities and Exchange Commission (“SEC”); Ehlers Investment Partners, LLC (“EIP”), an investment adviser registered with the SEC; and Bond Trust Services Corporation (“BTS”), holder of a limited banking charter issued by the State of Minnesota.

This communication does not constitute an offer or solicitation for the purchase or sale of any investment (including without limitation, any municipal financial product, municipal security, or other security) or agreement with respect to any investment strategy or program. This communication is offered without charge to clients, friends, and prospective clients of the Affiliates as a source of general information about the services Ehlers provides. This communication is neither advice nor a recommendation by any Affiliate to any person with respect to any municipal financial product, municipal security, or other security, as such terms are defined pursuant to Section 15B of the Exchange Act of 1934 and rules of the MSRB. This communication does not constitute investment advice by any Affiliate that purports to meet the objectives or needs of any person pursuant to the Investment Advisers Act of 1940 or applicable state law. In providing this information, The Affiliates are not acting as an advisor to you and do not owe you a fiduciary duty pursuant to Section 15B of the Securities Exchange Act of 1934. You should discuss the information contained herein with any and all internal or external advisors and experts you deem appropriate before acting on the information.