The minutes of the Federal Open Market Committee (FOMC) meeting of April 27-April 28, 2021 were released last week, revealing general agreement among Fed officials to continue supporting the economy through near zero interest rates and asset purchases. The Fed is presently buying $80 billion of U.S. Treasuries and $40 billion of agency mortgage backed securities every month in an effort to progress its goals of maximum employment and 2% average inflation.

Since the April FOMC meeting, the Labor Department reported the consumer price index rose 4.82% for the 12 months through April 2021. Core prices (which exclude food and energy) rose 0.9% in April from the prior month, representing the fastest one-month gain since 1981, far exceeding economists’ expectations. Consumer inflation is based on products consumers buy directly. The labor market is about 8 million jobs short of pre-pandemic levels.

Still, the minutes also revealed some policy makers support adjusting the pace of asset purchases soon. Patrick Harker, president of the Federal Reserve Bank of Philadelphia, and Dallas Federal Reserve president, Rob Haplan (both non-voting members of the FOMC), stated late last week that continued strength in the labor market and inflation rising above 2% for a period of time should warrant discussions about tapering asset purchases.

Note the above remains a minority viewpoint at this time. Fed Chair Jerome Powell and a majority of his colleagues have maintained it is too soon to begin these discussions, as it will take some time to achieve the established “substantial progress” benchmarks, particularly in the labor market. On the labor front, for the week ending May 15th, initial unemployment claims through regular state programs dropped to 444,000, marking a new low point since the beginning of the pandemic. This is the lowest level of initial claims since March 14, 2020 when it was 256,000.

Mary Daly, President of the Federal Reserve Bank of San Francisco, stated Friday in an interview with Bloomberg News that inflation should be elevated through the end of 2021 as supply chain constraints continue and the “base effect” that compares prices this year to last year’s pandemic-induced price declines. Daly echoed the position of Chair Powell, stating more time and patience is needed given 8 million people are still unemployed compared to pre-pandemic levels.

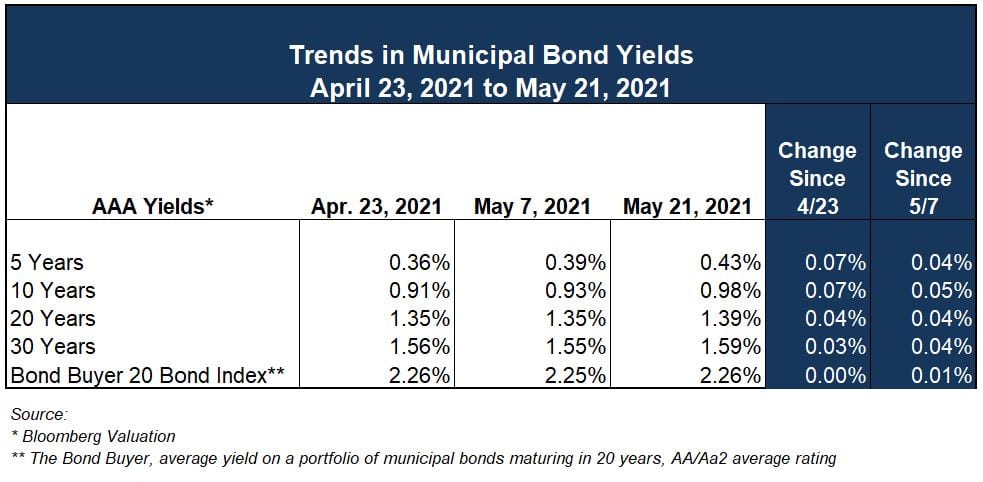

There have not been significant changes in municipal bonds yields over the past several weeks and the overall factors influencing market conditions have also remained stable. For example, municipal bond supply is still not meeting demand. As the economy starts to recover across the country and tax receipts improve, there will also be an influx of federal dollars from the American Recovery Plan – all of which could impact the timing and amount of future municipal debt issuance. Municipal bond volume this week is $7 billion ahead of a shortened holiday week – a little less than the recent average.

Congressional Consideration of Municipal Finance Tools Continues

It is anticipated more details will emerge later this week regarding the Biden Administration’s tax policies that will be incorporated into its 2022 budget. Part of the broader infrastructure legislation could include several municipal finance tools such as reinstatement of tax-exempt advance refundings, increasing the limit for tax-exempt bank qualified debt from $10 million to $30 million per calendar year, and restoration of direct pay bonds.

The Bond Buyer reports that reinstatement of tax-exempt advance refundings appears to have the broadest bipartisan support. Tax-exempt advance refundings were eliminated as part of the 2017 Tax Cuts and Jobs Act. The prospective loss of revenue to the federal government by restoring this tool now pales in comparison to the trillions spent on COVID relief packages, supporters argue.

American Infrastructure Bonds (AIBs), a form of direct pay bond similar to the Build America Bond (BABs) program in place from 2009-2010, allows taxable bonds to be issued for any public purpose expenditure that is eligible to be financed with tax-exempt debt. The U.S. Treasury would make a direct payment to the issuer of the taxable bonds equal to 28% of the interest. The AIB program would be exempt from the federal sequestration process that allow for direct payments to issuers be reduced for prior programs like BABs.

The exemption from the federal sequestration process will be meaningful to issuers to address one of the frustrations of prior direct pay bonds. Sequestration is the process of automatic budget cuts that kick in when Congress cannot agree on the budget. This began back in 2012 when the federal subsidy was initially reduced by the U.S. Treasury. Many issuers included an extraordinary call provision for direct pay bonds that allowed them to redeem those bonds at face value in the event the direct payment was reduced, thus allowing the direct pay bonds to be called in full on or after the event and permitting tax-exempt current refundings of the remaining principal balance.

The overall scope of any federal infrastructure package remains to be seen in terms of direct aid to state and local governments and/or additional public finance tools aimed at broadening options to fund infrastructure directly.

Required Disclosures: Please Read

Ehlers is the joint marketing name of the following affiliated businesses (collectively, the “Affiliates”): Ehlers & Associates, Inc. (“EA”), a municipal advisor registered with the Municipal Securities Rulemaking Board (“MSRB”) and the Securities and Exchange Commission (“SEC”); Ehlers Investment Partners, LLC (“EIP”), an investment adviser registered with the SEC; and Bond Trust Services Corporation (“BTS”), holder of a limited banking charter issued by the State of Minnesota.

This communication does not constitute an offer or solicitation for the purchase or sale of any investment (including without limitation, any municipal financial product, municipal security, or other security) or agreement with respect to any investment strategy or program. This communication is offered without charge to clients, friends, and prospective clients of the Affiliates as a source of general information about the services Ehlers provides. This communication is neither advice nor a recommendation by any Affiliate to any person with respect to any municipal financial product, municipal security, or other security, as such terms are defined pursuant to Section 15B of the Exchange Act of 1934 and rules of the MSRB. This communication does not constitute investment advice by any Affiliate that purports to meet the objectives or needs of any person pursuant to the Investment Advisers Act of 1940 or applicable state law. In providing this information, The Affiliates are not acting as an advisor to you and do not owe you a fiduciary duty pursuant to Section 15B of the Securities Exchange Act of 1934. You should discuss the information contained herein with any and all internal or external advisors and experts you deem appropriate before acting on the information.