The Federal Open Market Committee (FOMC) met last week and did not change the target range for the federal funds rate. After three previous cuts in the rate this year (the first since 2008), the decision to hold the rate was widely expected by economists and other fed watchers. Following the meeting, the FOMC also released its quarterly economic and interest-rate predictions indicating a consensus among members that no changes in the federal funds rate were expected in 2020 and slight increases possible in 2021 and 2022. The FOMC’s economic projections also estimated U.S. GDP growth at 2% in 2020 and 1.9% in 2022, very similar to their most recent prior projections.

Recession Fears Easing

A year ago, there were widespread expectations that the U.S. economy could experience a recession in 2019. While economic growth slowed in 2019, we also experienced continuing historic low unemployment rates, wage growth that is outpacing inflation, and strong consumer spending.

As we approach the new year, fears of a recession in the next year seem to have faded. An article in The Bond Buyer¹ cited comments from several economists. Markus Schomer of PineBridge Investments said, “economic analysis suggests average growth at best,” but no recession. Fred Cannon of Keefe, Bruyette & Woods stated that the markets expect “a Goldilocks economy: not too hot, not too cold, not much movement up in rates, and not much movement down.”

In previous Commentaries, we have cited some of the risk factors behind market turmoil, including the uncertainty of Brexit and ongoing trade tensions between the U.S. and China. Last week brought some increased clarity to both of those issues. The overwhelming electoral victory of Boris Johnson and his party in the United Kingdom suggests the U.K. is likely to follow through on its planned exit from the European Union. Johnson’s win may have reduced the uncertainty around the U.K.’s economy, but it may also bring on new uncertainty about the impact of Brexit on the EU and how the member countries’ economies may fare post-Brexit.

There also was news last week on the U.S.-China trade front. On Thursday morning, December 12, President Trump tweeted that U.S. negotiators were getting “VERY close to a BIG DEAL with China.” This led to a stock market rally on Thursday morning – with the Dow Jones Industrial Average and the S&P 500 reaching new record highs – accompanied by a spike in bond yields (the 10-year treasury yield increased by 13 basis points during the day). There is some dispute about whether the actual “phase one agreement” announced later that day will have much impact. Zach Abraham of Bulwark Capital Management said the deal “appears to be nothing more than cosmetic market fodder.”² On previous occasions where a perceived deal had been reached, one or both sides changed tone and indicated an unraveling of what were perceived to be basic tenets of the framework. It could be argued that the market has lived with the current state of affairs long enough that any breakdown may not materially impact financial markets, even with the recent run-up in stocks on the news.

Muni Market Finishing a Busy Year

For the municipal bond market, a busy year is quickly drawing to a close; there will be very few bond sales over the weeks of December 23 and December 30. The year started slow, with bond dealers concerned about the low volume of bonds being issued. By the fourth quarter of the year, however, volume picked up considerably. The biggest growth came from sales of taxable munis, many of which were used to advance refund existing tax-exempt issues.

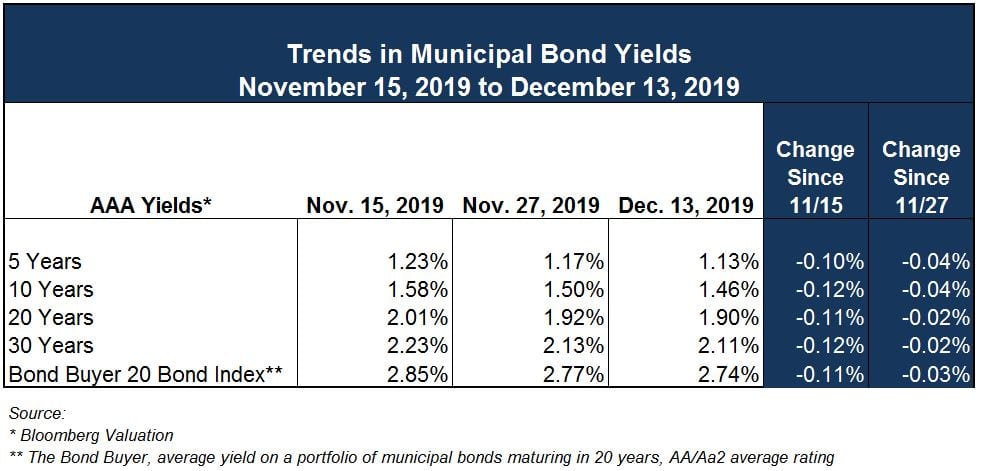

Muni yields declined for most of the first eight months of the year and have increased modestly since then. For example, the 10-year AAA yield reported daily by Bloomberg BVAL started the year at 2.29%, gradually declined to a low of 1.25% on August 28, and was at 1.46% at the end of the day on Monday, December 16.

Over the previous two weeks, muni yields have decreased very slightly, as shown in the table below.

Aaron Weitzman of The Bond Buyer² wrote “muni market leaders believe that 2020 will look a lot like 2019 – with high volume, increasing taxable issuance and strong demand.” For the time being, the market has absorbed this increased volume with ease. Competitive sales have seen increased numbers of bidders and negotiated sales have generally been oversubscribed.

At Ehlers, we have a lot of bond sales already scheduled for January and February. We are anxious to see the trends the new year will bring. As always, we will be ready to keep our clients informed of market trends and assist them with the issuance and management of their debt and investments. We wish our readers Happy Holidays and a wonderful New Year!

¹The Bond Buyer, December 3, 2019

²The Bond Buyer, December 16, 2019

IMPORTANT INFORMATION: PLEASE READ

The information contained herein reflects, as of the date hereof, the view of Ehlers & Associates, Inc. (or its applicable affiliate providing this publication) (“Ehlers”) and sources believed by Ehlers to be reliable. No representation or warranty is made concerning the accuracy of any data compiled herein. In addition, there can be no guarantee that any projection, forecast or opinion in these materials will be realized. Past performance is neither indicative of, nor a guarantee of, future results. The views expressed herein may change at any time subsequent to the date of publication hereof. These materials are provided for informational purposes only, and under no circumstances may any information contained herein be construed as “advice” within the meaning of Section 15B of the Securities and Exchange Act of 1934, or otherwise relied upon by you in determining a course of action in connection with any current or prospective undertakings relative to any municipal financial product or issuance of municipal securities. Ehlers does not provide tax, legal or accounting advice. You should, in considering these materials, discuss your financial circumstances and needs with professionals in those areas before making any decisions. Any information contained herein may not be construed as any sales or marketing materials in respect of, or an offer or solicitation of municipal advisory service provided by Ehlers, or any affiliate or agent thereof. References to specific issuances of municipal securities or municipal financial products are presented solely in the context of industry analysis and are not to be considered recommendations by Ehlers.