This past Monday (November 30), President-Elect Joe Biden picked former Federal Reserve Chair, Janet Yellen, as the next Secretary of the Treasury. If confirmed, Yellen would be the first female to take the job, though she and other cabinet picks won’t be formally considered until January 2021.

Many believe President-elect Biden’s selection of Janet Yellen as Treasury secretary signals he plans to act aggressively to revive the U.S. economy. Some of the local government related policy issues that bear watching include the following detailed below.

Municipal Lending Facility and Federal Support for the Municipal Market

Yellen’s first step may be to seek unity between the Fed and Treasury, the two institutions at the front lines of any economic crisis. For background, current Treasury Secretary Steven Mnuchin opened a rift between the agencies last week when he declined to extend several crisis-lending programs the Fed created via the Coronavirus Aid, Relief, and Economic Security (CARES) Act that expire December 31, 2020. This includes the Municipal Lending Facility (MLF), which seemed to temper muni market volatility earlier this year in March and early April. The scope of the MLF was originally quite narrow and subsequently expanded, affording state and local governments experiencing financial stress due to COVID-19 impacts a capital backstop through a lending program administered by the Fed. This emergency lending mechanism is similar in thrust and scope as the Troubled Asset Relief Program (TARP) program in 2008, which if you recall, helped to stabilize the financial markets and provided a lifeline to failing banks. The Fed said it opposed ending the programs but agreed to return hundreds of billions of dollars in backstop money to Treasury.

To date, the announcement of the end of the MLF hasn’t had much impact on the municipal market. One reason could be the fact the MLF has barely been used thus far (and probably wouldn’t be used much in 2021 either), due to narrow applicability and the penalty rates associated with the program vs. financing costs available in the capital markets In fact, since its inception, only two municipal issuers have tapped its funds:

- State of Illinois drew down $1.2 billion in June 2020 (and is expected to draw down an additional $2 billion before the MLF expires at year-end); and,

- Metropolitan Transportation Agency of New York (MTA) drew down $450 million in August 2020 (and is expected to draw down an additional $2.9 billion before the MLF expires at year-end).

Both are considered distressed credits – Illinois is the lowest-rated state in the nation and there is much speculation it may soon be downgraded to below investment grade. And the MTA is facing massive drops in ridership, as well as significant capital improvement needs. Generally, the market seems to be functioning fairly well and many issuers are taking advantage of low yields (which in many cases, may be lower than what they could get from the MLF). For example, the State of New Jersey, which about a month ago was considering tapping the MLF for deficit financing, was able to successfully price $3.67 billion of COVID-19 General Obligation Emergency Bonds at a true interest cost of 1.95%, providing evidence that access to the capital markets remains available to challenged credits.

In sum, it is unclear what Yellen may do about the MLF. On one hand, she may favor having emergency programs in place, “just in case.” On the other, she stated as part of a 2015 Congressional testimony that she did not believe the Federal Reserve should be a creditor for state and local governments. That said, considering all sides, letting the MLF expire may not be all that important right now given the impact may likely be inconsequential, especially as there continues to be strong demand for municipal bonds. Additionally, the facility could probably be re-instated very quickly (if needed) since the precedent is set and the incoming administration appears more favorable towards providing states and local governments greater support to address pandemic-related challenges.

Short-Term Fiscal Relief

Although the positive vaccine news provides for a glimmer of hope of and eagerness for post-pandemic economic growth, rising COVID-19 cases have prompted governments to respond with more lockdowns, pushing down near-term economic growth and momentum. Our last Market Commentary noted prospects of any additional near-term federal stimulus look dubious at best, particularly with a lame duck Congress. Indeed, there has not been a major second round of stimulus since the CARES Act in March. However, on Tuesday (December 1), a bipartisan group of U.S. senators proposed a $908 billion spending package to break the deadlock on fiscal stimulus, reflecting the growing anxiety in Washington over the state of the national economy.

As many had previously speculated, this next round focuses on providing additional relief for state and local governments ($160 billion), individuals ($180 billion for unemployment benefits), and small businesses ($288 billion). It is unclear, though, if this bipartisan plan will be able to muster enough congressional support. Democratic congressional leaders have yet to agree to a lower price tag, which could provide a path towards compromise and passage. Similarly, the Trump administration and Senate GOP leaders have shown little interest in moving closer to Democratic demands.

In response to the proposal, President-elect Biden said, “Any package passed in the lame duck session is likely to be at best just a start.”[1] However, the size of any ultimate package will likely hinge on the outcome of two Senate run-off races in Georgia, which will determine if the GOP retains control of the chamber. Even so, the ultimate “stimulus” will be the arrival of one or more effective coronavirus vaccines, which could herald the return to normal life.

Policy Changes

As part of his “Build Back Better” plan, President-elect Biden promised to focus on infrastructure. To that end, The Bond Buyer reports his administration is likely to favor wider use of private activity bonds (PABs)[2], just as its federal cap for surface transportation is almost at full capacity.[3] An increase of $15 billion to the PAB allotment may come in the next Congress to help build out transit systems, reduce greenhouse gas emissions, and reinvest in infrastructure.

Any increase in the PAB cap is likely to be included in an infrastructure bill, which would require bipartisan support to make it through a potentially divided Congress, as well as the yet-to-be-named Transportation Secretary.

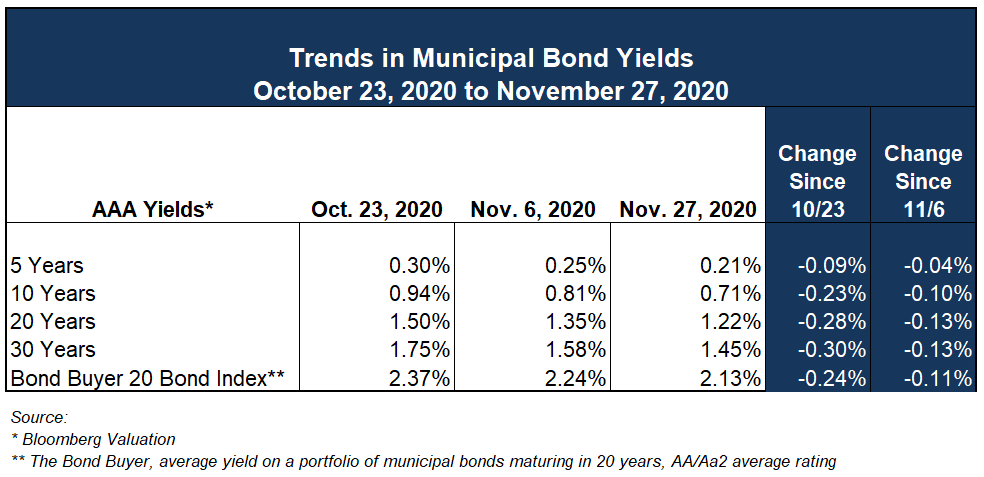

Trends in Municipal Bond Yields

Municipal bond yields have trended downwards over the past couple of weeks but seem to have stabilized from the beginning through the end of the holiday-shortened week. Longer-maturity U.S. Treasury yields closed slightly higher last week, while shorter maturity yields were nearly unchanged to somewhat lower. Positive market risk sentiment lifted Treasury rates early in the week as investors digested positive coronavirus vaccine news and an orderly transfer of U.S. political power.

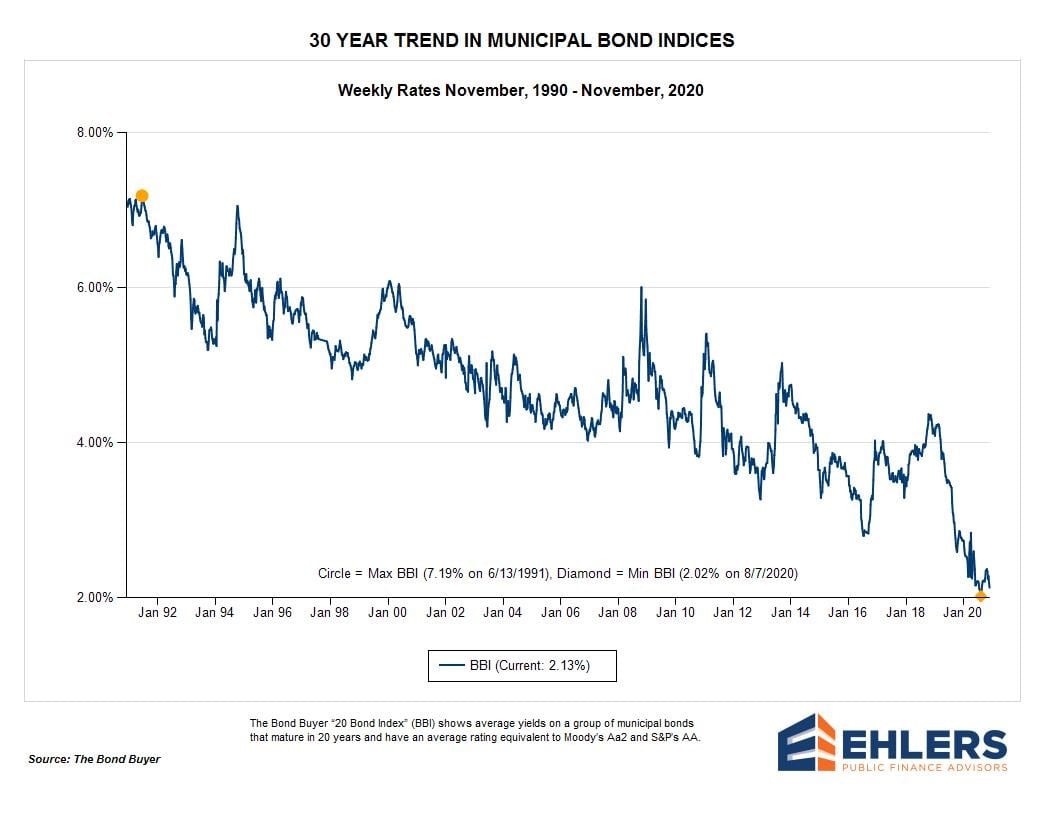

Looking forward to year-end, The Bond Buyer reports 2020 will end with a new record for muni bond issuance at $440.83 billion in 11,892 transactions compared to $426.34 billion and 11,594 transactions in 2019, mostly due to higher taxable bond issuance.[4] There also seems to be continued strong demand for muni bonds, as indicated by sustained inflows to muni bond funds for the past three months, helping to drive down yields to near all-time lows (see chart below).

[1] https://www.ft.com/content/f14535bf-cd60-4a1c-aa7c-2b46e16e52b8

[2] Private activity bonds allow municipal governments to borrow on behalf of private privates while maintaining the bonds’ tax exempt status.

[3] https://www.bondbuyer.com/news/biden-likely-to-favor-pabs-to-finance-infrastructure-wish-list

[4] https://www.bondbuyer.com/news/yearly-muni-bond-volume-to-hit-record

Required Disclosures: Please Read

Ehlers is the joint marketing name of the following affiliated businesses (collectively, the “Affiliates”): Ehlers & Associates, Inc. (“EA”), a municipal advisor registered with the Municipal Securities Rulemaking Board (“MSRB”) and the Securities and Exchange Commission (“SEC”); Ehlers Investment Partners, LLC (“EIP”), an investment adviser registered with the SEC; and Bond Trust Services Corporation (“BTS”), holder of a limited banking charter issued by the State of Minnesota.

This communication does not constitute an offer or solicitation for the purchase or sale of any investment (including without limitation, any municipal financial product, municipal security, or other security) or agreement with respect to any investment strategy or program. This communication is offered without charge to clients, friends, and prospective clients of the Affiliates as a source of general information about the services Ehlers provides. This communication is neither advice nor a recommendation by any Affiliate to any person with respect to any municipal financial product, municipal security, or other security, as such terms are defined pursuant to Section 15B of the Exchange Act of 1934 and rules of the MSRB. This communication does not constitute investment advice by any Affiliate that purports to meet the objectives or needs of any person pursuant to the Investment Advisers Act of 1940 or applicable state law. In providing this information, The Affiliates are not acting as an advisor to you and do not owe you a fiduciary duty pursuant to Section 15B of the Securities Exchange Act of 1934. You should discuss the information contained herein with any and all internal or external advisors and experts you deem appropriate before acting on the information.