Thanks to strong consumer spending and a very low unemployment rate of 3.5%, the U.S. economy continues to grow. Indeed, sustained strong job growth, low unemployment, and gains in real earnings are lifting consumers’ disposable incomes, while low interest rates are reducing debt service costs and making large ticket items (e.g. cars and homes) more affordable.

That said, investors have been seeking signs of recession risks throughout these past couple years as the economic expansion has lasted more than 10 years – a record. Global political volatility, the 2020 election season, U.S./China trade wars, etc. have exacerbated those fears from time to time. Last Friday (February 14), the Federal Reserve Bank of New York’s Nowcast prediction for first quarter GDP indicated U.S. GDP growth was expected to be 1.4%, down from the 1.7% previously expected the week before. From their press release, “Negative surprises from capacity utilization and industrial production data drove most of the decrease.”¹

Impact of the Coronavirus

This holiday-shortened week for the markets could provide an early look at the impact of the coronavirus on the global economy, particularly on Wednesday when the Federal Reserve’s Open Market Committee releases minutes of its January 28-29 policy meeting, which could provide insights into how the Fed is thinking about potential economic risks.

As we mentioned in our prior commentary, the CME FedWatch tool briefly showed a 20% probability of a quarter-point rate cut at the Federal Open Market Committee’s (FOMC) March meeting. However, the vast majority of market participants expect no change to the target range for the fed funds rate at the meeting. Given the strength of U.S. economic growth and a muted inflation outlook, any expectations of future rate cuts appear to be driven by the expected impact of the coronavirus on the global economy.

To recap, mainland China currently has more than 70,000 confirmed coronavirus (named COVID-19) cases, according to the World Health Organization. Outside of China, the largest cluster of cases remains the Diamond Princess cruise ship that is presently quarantined at a terminal in Yokohama, Japan with 542 out of the approximately 3,700 people originally aboard. Hundreds have now disembarked, either to receive care at local hospitals or in the case of 328 Americans, to fly back to the U.S. on special evacuation flights and be quarantined at either the Lackland Airforce Base in Texas or Travis Air Force Base in California.

Last week, two regional Federal Reserve officials said the COVID-19 was casting uncertainty over the U.S. economic outlook. However, neither suggested it was time to change rates after the FOMC lowered them by 75 bps last year – meaning, they are taking a “wait and see” approach for the time being. Notably, St. Louis Fed President James Bullard (who has a vote on the FOMC) was recently quoted in the Wall Street Journal saying “the efforts to bring the virus under control are substantial enough that the Chinese economy is expected to grow noticeable [sic] slower in the first quarter of 2020 than it otherwise would have…Experience with previous viral outbreaks suggest that the effects on U.S. interest rates can be tangible and last until the outbreak is clearly contained.”²

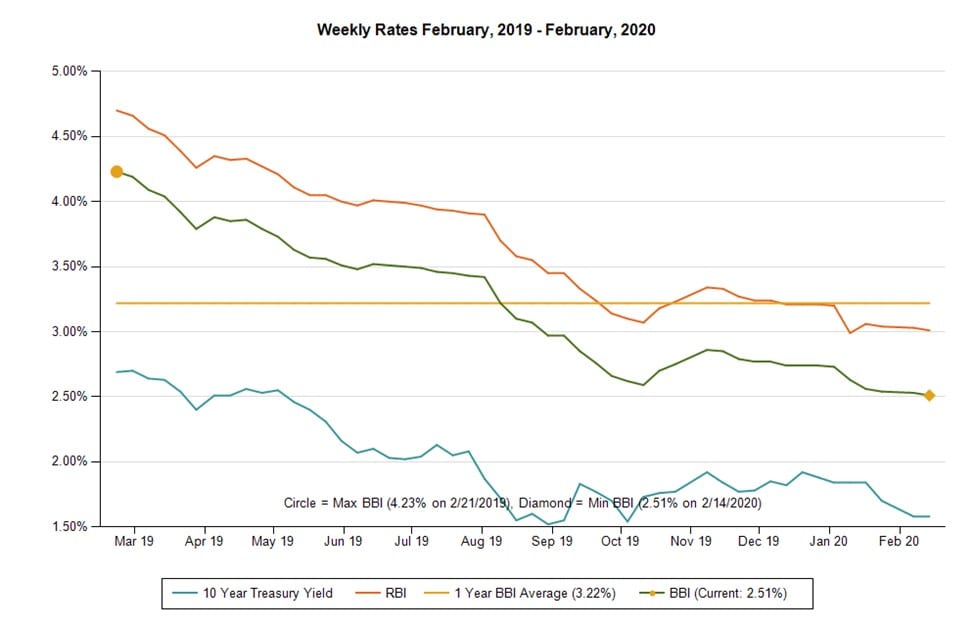

Trends in Yields

U.S. Treasury yields increased marginally last week, led by the short end of the curve. Yields rose on optimism about the containment of COVID-19 in China but waned later in the week as a new approach to diagnosing the virus resulted in a surge of new cases. CPI data released late last week showed some increase in inflation but the recent decline in commodity prices will likely put downward pressure on inflation. Fed Chairman Powell also suggested last week there was no fear of inflation and therefore no need to raise rates.

The municipal bond market remained more or less unchanged from the prior week, along with U.S. Treasuries. Higher demand and below-normal new supply have boosted the price of municipal bonds relative to Treasuries and well below the historical average yield ratios of 84% and 93% for 10- and 30-year maturities; current ratios are roughly 74% and 89%, respectively. As supply has declined, demand for municipals has sustained in appetite. In fact, the municipal market has seen 57 consecutive weeks of positive flows into municipal bond mutual funds, primarily due to the limit on state and local tax deductions and investors from high tax states looking for tax-exempt income.

Municipal bonds are expensive by all measurements, but low supply and high demand for tax-exempt bonds should keep a strong bid under prices for the foreseeable future. As previously stated in our prior Commentary and shown in the graph above, it is an excellent time to execute refunding transactions and/or new money bonds. In fact, combining the two typically results in an optimal outcome.

¹https://www.newyorkfed.org/research/policy/nowcast/overview.html

IMPORTANT INFORMATION: PLEASE READ

The information contained herein reflects, as of the date hereof, the view of Ehlers & Associates, Inc. (or its applicable affiliate providing this publication) (“Ehlers”) and sources believed by Ehlers to be reliable. No representation or warranty is made concerning the accuracy of any data compiled herein. In addition, there can be no guarantee that any projection, forecast or opinion in these materials will be realized. Past performance is neither indicative of, nor a guarantee of, future results. The views expressed herein may change at any time subsequent to the date of publication hereof. These materials are provided for informational purposes only, and under no circumstances may any information contained herein be construed as “advice” within the meaning of Section 15B of the Securities and Exchange Act of 1934, or otherwise relied upon by you in determining a course of action in connection with any current or prospective undertakings relative to any municipal financial product or issuance of municipal securities. Ehlers does not provide tax, legal or accounting advice. You should, in considering these materials, discuss your financial circumstances and needs with professionals in those areas before making any decisions. Any information contained herein may not be construed as any sales or marketing materials in respect of, or an offer or solicitation of municipal advisory service provided by Ehlers, or any affiliate or agent thereof. References to specific issuances of municipal securities or municipal financial products are presented solely in the context of industry analysis and are not to be considered recommendations by Ehlers.