Financial market performance for the first month of the calendar year would have made for a great proverbial amusement park ride. Volatility reigned across nearly every major asset class. Broad stock market indices saw some of the best and worst single-day moves in nearly a year or more, with percentage gains and losses of 2% – 3% (and more). The S&P 500 finished the month strong, recovering from what was at one point a 10% monthly decline to finish January with a 5.3% loss. The Nasdaq 100 surged 6.6% in two sessions to close out the month with a loss of 8.5%, the worst since December of 2018. The Dow Jones Industrial Average experienced large intraday swings, sometimes in the neighborhood of 1,000 points, ending the month with a modest decline of 3.3%.

Fixed income was not a safe haven during this time, as there was a steady rise in yields, which were most pronounced on the shorter end of the interest rate curve. Increases in yields for U.S. Treasuries during the month of January ranged from about 30 – 45 basis points (1 basis point = 0.01%) from 1 – 7 years, with the most pronounced increases at the 2-year mark. The benchmark 10-year Treasury rose in yield by nearly 30 bps to just under 1.80%. These recent moves in rates have resulted in what market observers would describe as a “bear flattening” of the curve, where the spread between short and long rates compresses. In fact, the spread between 2- and 10-year Treasuries is presently the tightest it has been since October of 2020.

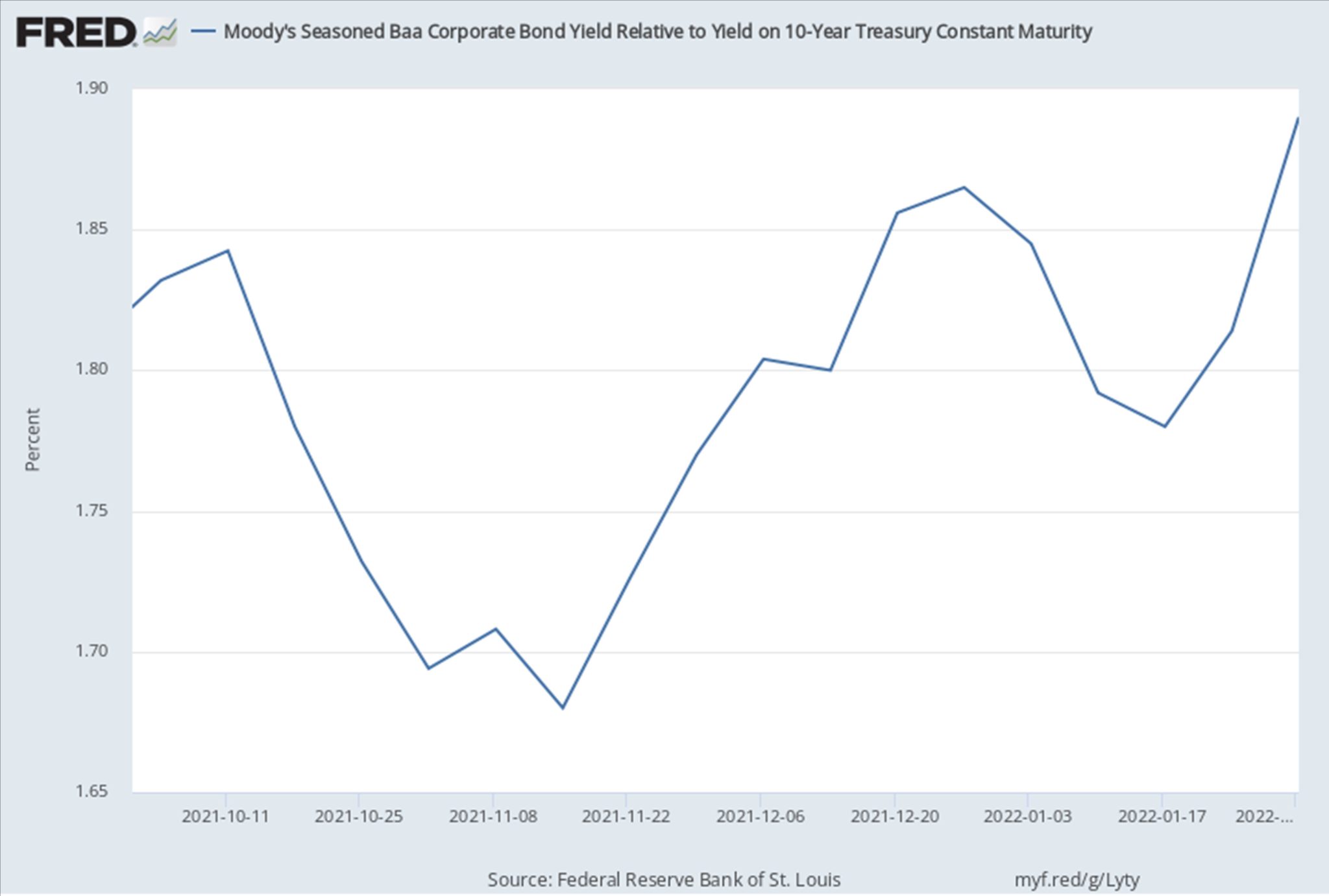

Broad bond market indices were down 2% – 3% for the month, depending on their duration and composition. Investment grade bonds tallied their fifth-worst monthly performance on record, according to CreditSights. High yield, or “junk bonds,” posted one of the worst starts to the year ever based on metrics provided by Bloomberg. This was a result of not only increasing yields generally, but widening credit spreads, as represented in the chart below, although for the lowest class of investment grade credit (“Baa”).

Market Continues to Adapt in Anticipation of Fed Actions

The Federal Open Market Committee (FOMC) concluded its January meeting last Wednesday, January 26. The customary policy statement did not necessarily provide any surprises – rather it largely reiterated the FOMC’s intentions previously communicated to the market. The Fed will continue with reductions in monthly asset purchases through March of this year. The policy statement carried a more definitive assessment of potential changes to the target range for the fed funds rate. “With inflation well above 2 percent and a strong labor market, the Committee expects it will soon be appropriate to raise the target range for the federal funds rate.” Prior FOMC statements indicated increases to the fed funds rate would occur only after asset purchases were ended entirely. This would align with the FOMC’s next scheduled meeting for mid-March, and the market is widely anticipating a quarter-point increase in the fed funds rate upon conclusion of that meeting, although there has been ample speculation of a half-point increase. If the FOMC indeed declares an increase to the fed funds rate in March, it will be the first such action since December of 2018.

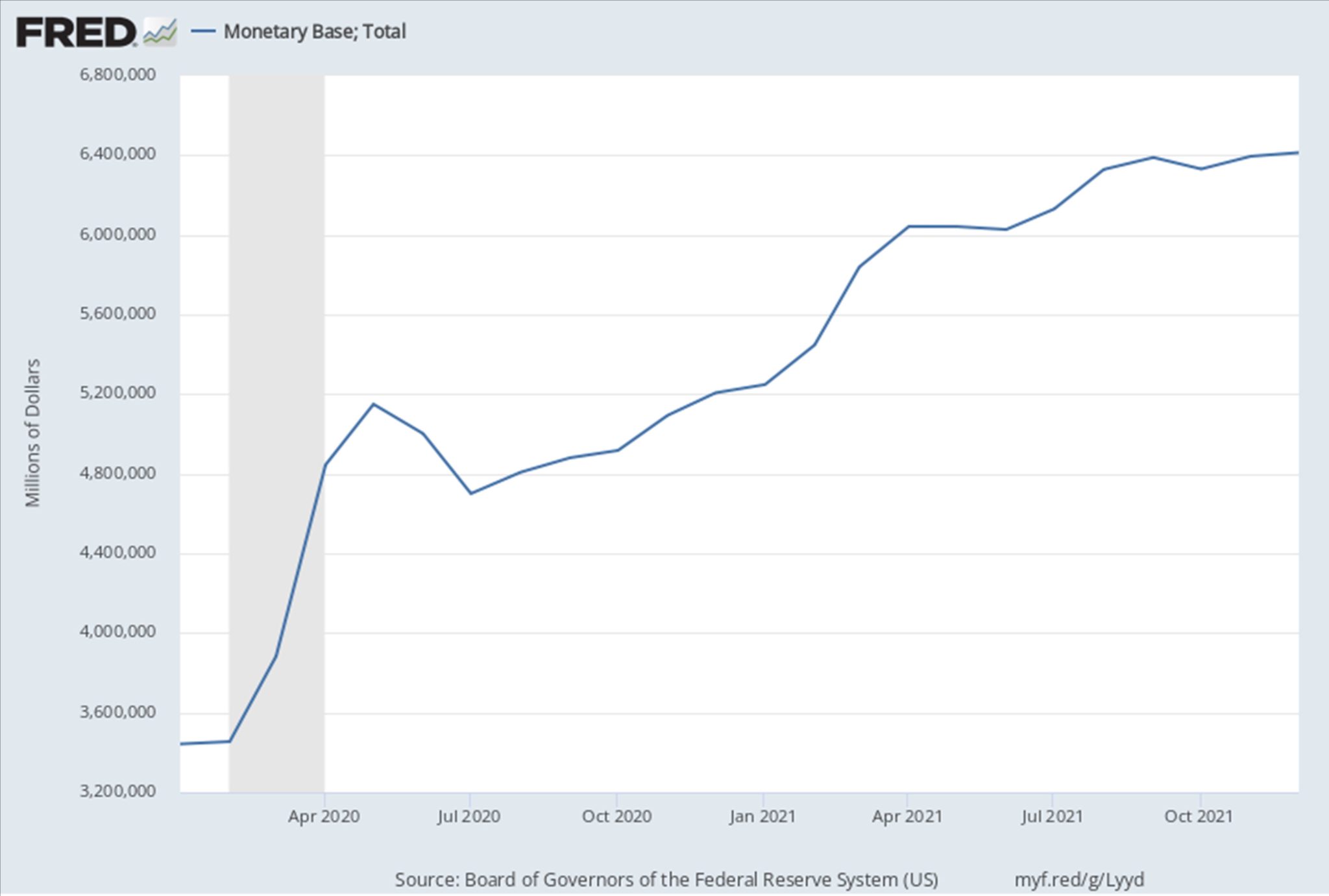

Markets are clearly at an inflection point, as investors attempt to digest what may be the end of one the most aggressive monetary policy postures across the globe in modern history. The Fed’s balance sheet has expanded to over $9 trillion and broad measures of money supply have increased nearly 40% since February of 2020. The total monetary base has increased roughly 100% since the beginning of 2020.

In turn, financial assets are experiencing a “re-pricing” of sorts as investors adjust expectations amidst a backdrop of heavy uncertainty. Market participants generally view the Fed as “behind the curve” as we endure inflation at 40-year highs and nominal levels of GDP at 6.00%+, along with low measures of unemployment. This has clearly led to price discovery and higher levels of volatility have rippled through markets, as investors begin to contemplate the potential for more fed funds rate increases this calendar year than may have originally been thought. As recently as the final quarter of last year, there was a large consensus around three quarter-point rate hikes throughout 2022. Markets are now grappling with the prospect of four-to-five increases, which would bring the fed funds rate into a range of 1.00% – 1.25%. In light of generational highs in inflation, this could hardly be considered “tight” monetary policy in a historical context.

What was likely more unsettling for investors was the release of a policy statement from the FOMC that outlined “principles for reducing the size of the balance sheet.” Balance sheet reduction is considered a bit more “hawkish” than what markets have been anticipating from the Fed. During Chair Powell’s press conference, he stated, “The balance sheet is substantially larger than it needs to be… There’s a substantial amount of shrinkage in the balance sheet to be done. That’s going to take some time. We want that process to be orderly and predictable.” This process would see the Fed reinvest only some of its monthly cash inflows from existing bond holdings. Only time will tell what might be forthcoming.

Municipal Market

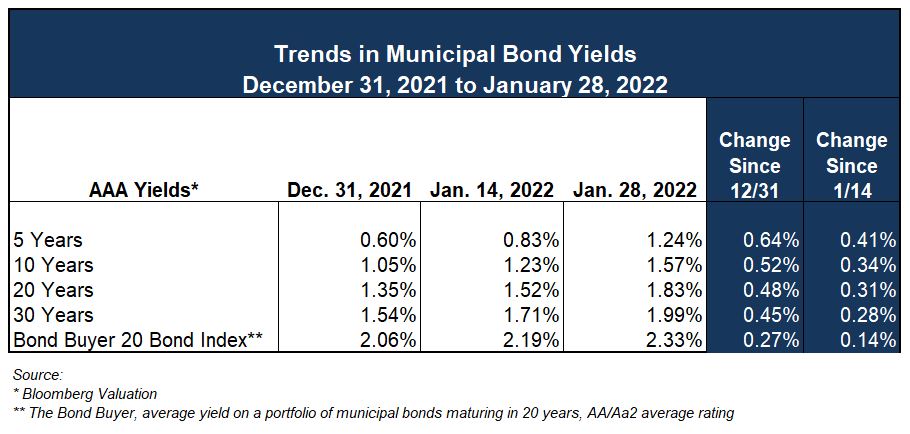

The municipal market was not immune to the aforementioned volatility, and monthly declines in fixed income. In fact, the downdraft in municipals was even greater than in taxable bonds. AAA-yields are up 45 – 65 basis points at major benchmarks. Much of this has to do with how “rich” tax-exempt bonds were priced before the recent run-up in yields. As we noted in our prior Market Commentaries, ratios of tax-exempt to taxable yields were at very low levels on a historical basis. The ratio at 5-years as of the beginning of this year was about 50%, and 70% at 10-years. At the end of the month, these ratios increased rather dramatically to 76% and 87%, respectively. The ratio at 10-years is the highest since about November of 2020.

This may be a swinging of the pendulum that could see some corrections over the next few weeks, with ratios declining to some degree. However, some damage has been done, with tax-exempt bond funds experiencing two consecutive weeks of investor withdrawals after an uninterrupted period of net inflows for nearly 40 straight weeks. Widely tracked municipal indices fell nearly 2.75% for the month of January, one of the worst performances in almost 40 years.

New issue volume reportedly declined in January roughly 15% year-over-year. This likely lessened the overall impact of increasing tax-exempt yields, as the market absorbed a smaller supply of new bonds. It’s not uncommon for issuers and borrowers to wait out volatility when seeking to price a new issue – weekly volume may ebb and flow as deal teams attempt to “pick their spot” with the expectation this heightened volatility will subside.

In the grand scheme, rates are still near generational lows, even if they have moved higher in the last month, or so. We generally recommend our clients take a long-term perspective to capital financing, using purposeful planning, so that interest rates are not their primary focus. For more interest rate sensitive initiatives, such as project finance and refundings, we might argue the preponderance of evidence suggests rates will have a bias to the upside for at least the foreseeable future.

Required Disclosures: Please Read

Ehlers is the joint marketing name of the following affiliated businesses (collectively, the “Affiliates”): Ehlers & Associates, Inc. (“EA”), a municipal advisor registered with the Municipal Securities Rulemaking Board (“MSRB”) and the Securities and Exchange Commission (“SEC”); Ehlers Investment Partners, LLC (“EIP”), an investment adviser registered with the SEC; and Bond Trust Services Corporation (“BTS”), holder of a limited banking charter issued by the State of Minnesota.

This communication does not constitute an offer or solicitation for the purchase or sale of any investment (including without limitation, any municipal financial product, municipal security, or other security) or agreement with respect to any investment strategy or program. This communication is offered without charge to clients, friends, and prospective clients of the Affiliates as a source of general information about the services Ehlers provides. This communication is neither advice nor a recommendation by any Affiliate to any person with respect to any municipal financial product, municipal security, or other security, as such terms are defined pursuant to Section 15B of the Exchange Act of 1934 and rules of the MSRB. This communication does not constitute investment advice by any Affiliate that purports to meet the objectives or needs of any person pursuant to the Investment Advisers Act of 1940 or applicable state law. In providing this information, The Affiliates are not acting as an advisor to you and do not owe you a fiduciary duty pursuant to Section 15B of the Securities Exchange Act of 1934. You should discuss the information contained herein with any and all internal or external advisors and experts you deem appropriate before acting on the information.