Traders are keeping one eye on the tense backdrop unfolding around Ukraine, which seems to be escalating with each passing day. But the focus has not shifted from U.S. economic and inflation data and the prospects of an imminent interest rate hike, or even a series of them.

The January Consumer Price Index (CPI), a widely followed inflation series, showed a 7.5% year-over-year increase, non-seasonally adjusted. This is the highest annualized increase since the 1980s. The CPI component with the largest 12-month increase continues to be energy, but even without energy the CPI basket shows a 6% increase. The big question now is whether the Fed will be able to adapt its policies in a fashion that does not stifle economic growth.

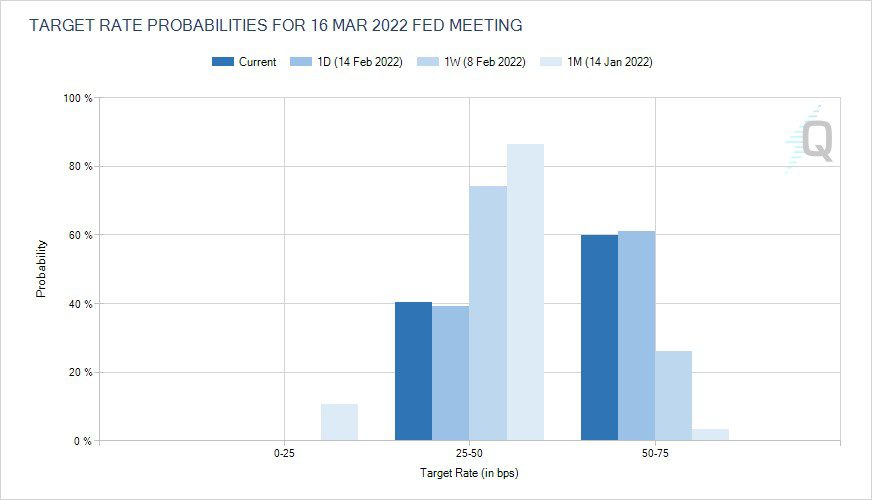

The below graph that is derived from the pricing of fed funds futures contracts depicts how attitudes have changed in the last month regarding a potential March fed funds rate increase.

The graph shows how attitudes toward the magnitude of a potential March fed funds rate increase changed from an 80% expectation of a quarter percent increases in January to a near 60-40 split in expectations for either a quarter or half point increase. This data reflects the changing attitudes from mid-January through mid-February about the urgency with which the Fed will need to react to inflation concerns.

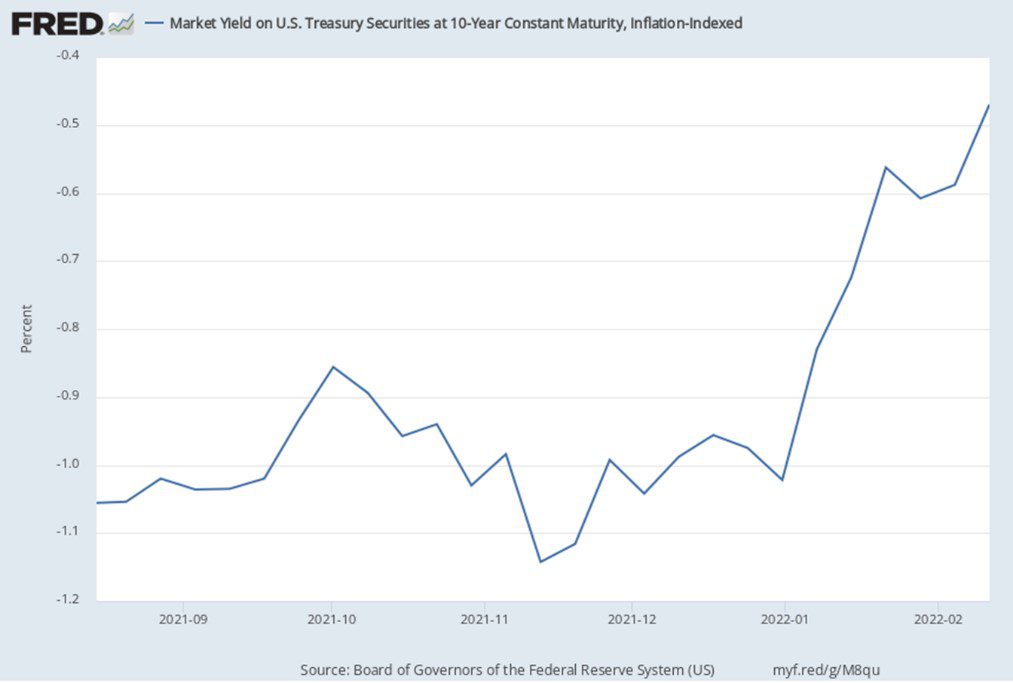

The following chart shows changes in the yield of 10-year Treasury Inflation Protected Securities (TIPS) over the past six months. TIPS are a type of Treasury security that are indexed to the Consumer Price Index (CPI) in order to protect investors from inflation. It’s clear that investor expectations for inflation are not abating, even in the face of the Fed’s stated intent to remove accommodation through reduction, and ultimately elimination, of asset purchases, as well as increases to the fed funds rate. The Fed’s credibility is on the line in order to adhere to one of its two mandates – price stability. Only time will tell if the Fed’s removal of accommodative monetary policy will be effective in managing increasing prices or if the issues surrounding supply chains and labor markets prevail.

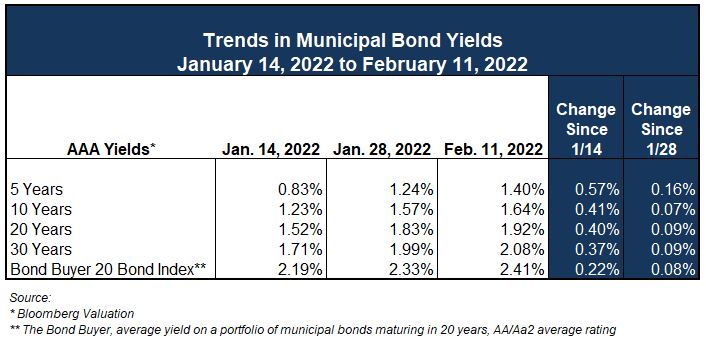

Trends in Municipal Bond Yields

As we have previously written, yields in the municipal market have certainly increased since the beginning of the year. That pressure has ebbed a bit, albeit with rates still higher in the last two weeks, with the most pronounced changes on the front end of the curve through about five years. Yields crept marginally higher this week.

Investor appetite for municipal debt has been on the same roller coaster ride as most other asset classes the last 6 weeks. The Investment Company Institute this week reported outflows from municipal bond mutual funds of just under $1 billion for the week ending Feb. 9th. This was significantly down from the $4.2 billion in outflows the previous week, reflecting potentially growing appetite. As previously discussed in this Commentary, the amount of bond redemptions through principal payments and calls is particularly heavy at this time of year, creating a reinvestment opportunity for those dollars. February will see $34 billion in total redemptions, and March will see another $20 billion.

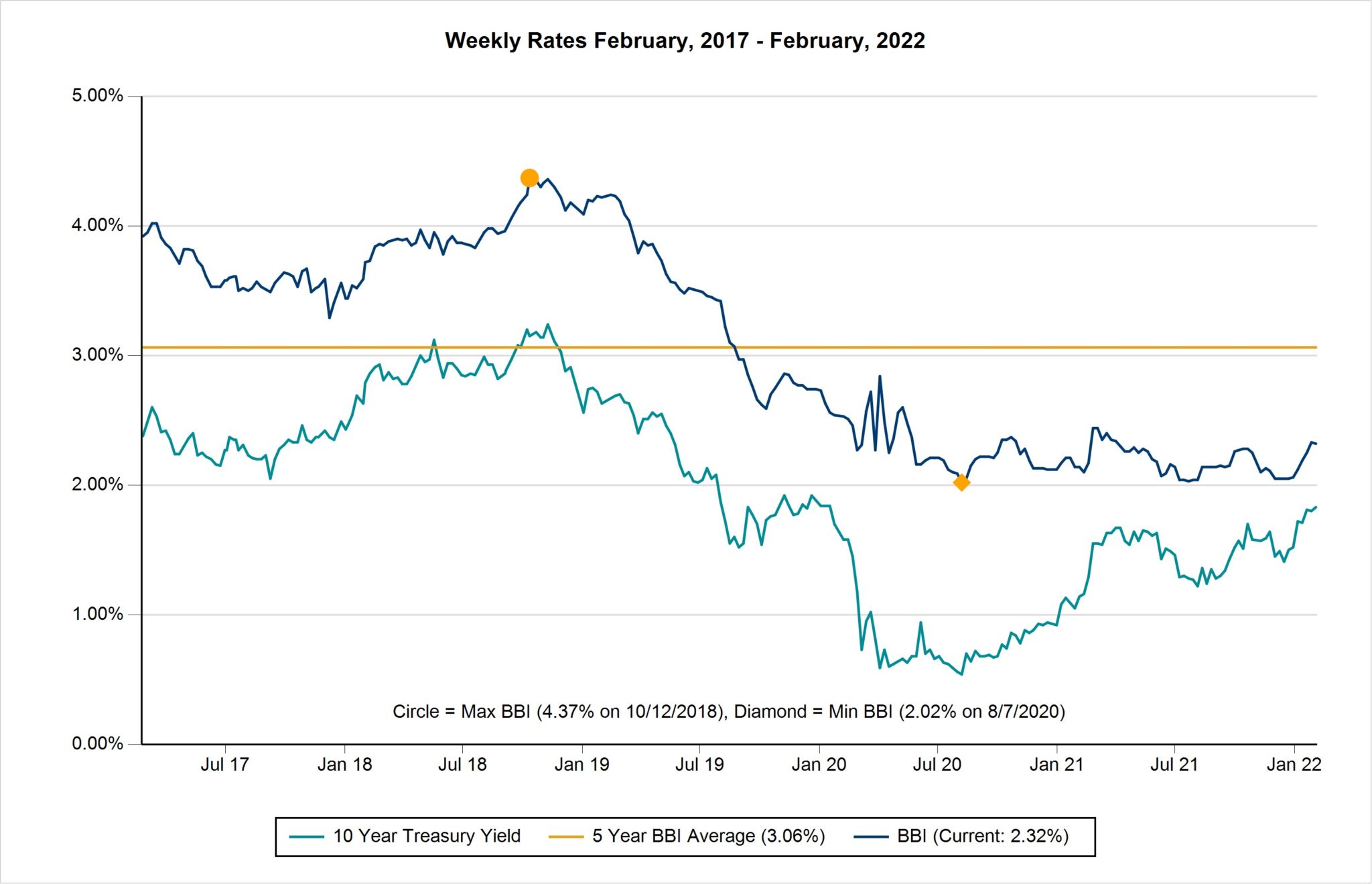

Though many headlines have concentrated on the uptick in municipal yields so far this year, for those looking at refunding opportunities it’s always worth stepping back and gaining perspective around the fact that we are still in a favorable interest rate environment (see below) from a generational point of view. Recent increases in rates have been abrupt, but time really needs to unfold to have a better sense of the longer-term trajectory and the state of the economy that will result.

Required Disclosures: Please Read

Ehlers is the joint marketing name of the following affiliated businesses (collectively, the “Affiliates”): Ehlers & Associates, Inc. (“EA”), a municipal advisor registered with the Municipal Securities Rulemaking Board (“MSRB”) and the Securities and Exchange Commission (“SEC”); Ehlers Investment Partners, LLC (“EIP”), an investment adviser registered with the SEC; and Bond Trust Services Corporation (“BTS”), holder of a limited banking charter issued by the State of Minnesota.

This communication does not constitute an offer or solicitation for the purchase or sale of any investment (including without limitation, any municipal financial product, municipal security, or other security) or agreement with respect to any investment strategy or program. This communication is offered without charge to clients, friends, and prospective clients of the Affiliates as a source of general information about the services Ehlers provides. This communication is neither advice nor a recommendation by any Affiliate to any person with respect to any municipal financial product, municipal security, or other security, as such terms are defined pursuant to Section 15B of the Exchange Act of 1934 and rules of the MSRB. This communication does not constitute investment advice by any Affiliate that purports to meet the objectives or needs of any person pursuant to the Investment Advisers Act of 1940 or applicable state law. In providing this information, The Affiliates are not acting as an advisor to you and do not owe you a fiduciary duty pursuant to Section 15B of the Securities Exchange Act of 1934. You should discuss the information contained herein with any and all internal or external advisors and experts you deem appropriate before acting on the information.