Market Overview

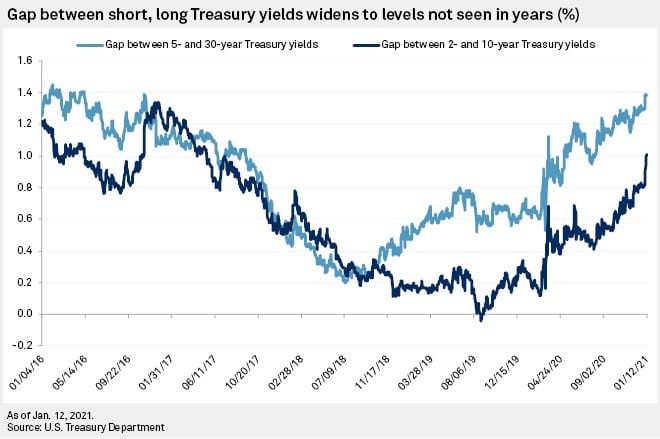

As the chart below demonstrates, the US Treasury yield curve has steepened (increased differential between short- and long-term rates) to a 4-year high, indicating a higher yield premium associated with investing at longer terms. This could be a result of greater expectations for economic growth or an increase in inflation expectations – or even some combination of both. Treasury yield spreads, or the difference between maturities at certain points along the yield curve, are at levels not seen since 2017, including several periods of “inversion” where short-term rates are higher than intermediate and even long-term rates. This steepening is primarily a result of intermediate rates increasing, with the benchmark 10-year Treasury yield rising by over 15 basis points (1 basis points = 0.01%) since the first of the year.

The COVID-19 Relief Bills, Compared

There seems to be bipartisan support for another legislative package to provide economic relief from the Covid-19 pandemic. Less clear is how that legislation will look. President Biden has released a $1.9 trillion Covid-19 relief package and on Monday Senate Republicans released their version, providing $618 billion in total.

Here are some of the key components of each proposal:

President Biden’s package:

- $160 billion to build up Covid-19 vaccinations and testing

- $1,400 direct stimulus checks

- $170 billion for schools and universities

- $350 billion in aid for state and local governments

- $40 billion in aid for childcare costs

- Supplemental unemployment checks increased to $400 per week through September

- Increased Federal minimum wage to $15/hour

- Expands earned-income tax credit and child tax credit

Senate Republican’s package:

- $160 billion to build up Covid-19 vaccinations and testing

- $1,000 direct stimulus checks (with more selective income requirements)

- $20 billion for K-12 schools

- No aid for state and local governments

- $20 billion in aid for childcare costs

- Maintains $300 per week supplemental unemployment checks through June

- No change to Federal minimum wage

- No changes to earned-income tax credit or child tax credit

Although the President has the advantage of being able to pass his proposed legislative package through Congress without bipartisan support, it remains to be seen whether that will happen. Democrats would need to use a procedure called reconciliation to get a bill through Congress without having to rely on Republican votes in the Senate to end debate, but the move is limited to measures without a budgetary impact. Meaning, a bill with at least 10 Republican votes to end debate could move faster while avoiding some of the constraints inherent in the reconciliation process.

On a related note, a group of Republican Senators met with the President Monday to discuss their proposal. The meeting lasted for roughly two hours and both sides agreed to continue talking, so we’ll just have to wait and see what the final compromise might look like, particularly how much state and local aid is included. ¹

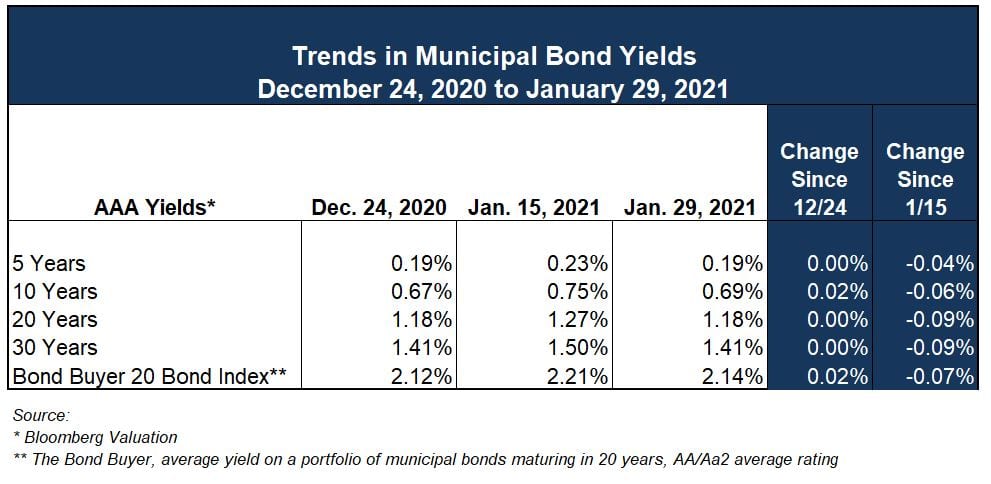

Trends in Municipal Yields

February opened with municipal yields mostly unchanged across the maturity spectrum, as has been the trend throughout 2021. The yield on a 10-year AAA municipal bond was unchanged on Monday at 0.73% (non-bank qualified), according to Municipal Market Data (MMD), down 4 basis points from a week earlier and up 2 basis points from the first trading day of January.

Another important data point relative to municipal yields is the Municipal-Treasury Ratio: on December 1, 2020 the 10-year Muni-Treasury Ratio was 76.9%, 78.7% on January 4th, and 67.8% on Monday of this week. The decline in the ratio is wholly related to increases in Treasury yields during a period of stable municipal rates.

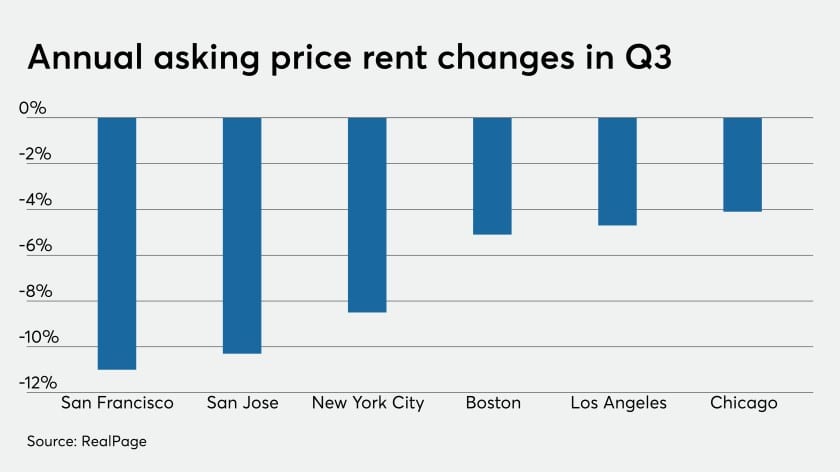

Pandemic Impact on Cities

The Covid-19 pandemic has reversed a long-term trend of growing urban centers. The question remains whether it will be a permanent or temporary shift, but the impact on municipal budgets is already being felt. Effective asking rents in some of America’s biggest cities have plummeted in the last few months. In the third quarter of 2020, asking rents were down 11% year-over-year in San Francisco, 8.5% in New York and 4% in Chicago (The Bond Buyer). New York City lost over 11,000 renters and apartment sales were down almost 50%. This supply-demand shakeup is a complete reversal of what had been a long-term trend of growing rents in the face of nearly insatiable rental demand in the “super star” cities (The Bond Buyer).

One immediate impact of this shift has been lower revenue (e.g. sales tax, occupancy, excise, and other demand-driven receipts) for state and local governments as travel, real estate and commercial activity continue to suffer greatly in major urban areas. Only time will tell how these tidal forces will shift demographics across the nation.²

Required Disclosures: Please Read

Ehlers is the joint marketing name of the following affiliated businesses (collectively, the “Affiliates”): Ehlers & Associates, Inc. (“EA”), a municipal advisor registered with the Municipal Securities Rulemaking Board (“MSRB”) and the Securities and Exchange Commission (“SEC”); Ehlers Investment Partners, LLC (“EIP”), an investment adviser registered with the SEC; and Bond Trust Services Corporation (“BTS”), holder of a limited banking charter issued by the State of Minnesota.

This communication does not constitute an offer or solicitation for the purchase or sale of any investment (including without limitation, any municipal financial product, municipal security, or other security) or agreement with respect to any investment strategy or program. This communication is offered without charge to clients, friends, and prospective clients of the Affiliates as a source of general information about the services Ehlers provides. This communication is neither advice nor a recommendation by any Affiliate to any person with respect to any municipal financial product, municipal security, or other security, as such terms are defined pursuant to Section 15B of the Exchange Act of 1934 and rules of the MSRB. This communication does not constitute investment advice by any Affiliate that purports to meet the objectives or needs of any person pursuant to the Investment Advisers Act of 1940 or applicable state law. In providing this information, The Affiliates are not acting as an advisor to you and do not owe you a fiduciary duty pursuant to Section 15B of the Securities Exchange Act of 1934. You should discuss the information contained herein with any and all internal or external advisors and experts you deem appropriate before acting on the information.