This site provides information for taxpayers of Independent School District 763 – Medford, regarding how the district’s proposed referendum may affect property taxes. The site was prepared in cooperation with Ehlers, the district’s independent municipal advisor. If you have questions about the information on this site, please contact Ehlers using the information provided below.

This site provides information for taxpayers of Independent School District 763 – Medford, regarding how the district’s proposed referendum may affect property taxes. The site was prepared in cooperation with Ehlers, the district’s independent municipal advisor. If you have questions about the information on this site, please contact Ehlers using the information provided below.

About the Referendum

The district will hold a special election on Tuesday, November 7, 2023 seeking voter approval of two ballot questions.

QUESTION 1 would authorize the district to issue an amount not to exceed $15,915,000 in bonds to provide funds for the acquisition and betterment of school sites and facilities, including the construction and equipping of a classroom addition, remodeling and addition to the career and technical education (CTE) space, and the construction and equipping of a multipurpose room usable for fitness and wrestling; remodeling and upgrades to the weight room; and ventilation upgrades to the school site and facility.

QUESTION 2 would authorize the district to issue an amount not to exceed $3,940,000 in bonds to provide funds for the acquisition and betterment of school sites and facilities, including the construction and equipping of a gymnasium addition; and the construction of a parking lot and retaining wall to support the gymnasium addition as required by building code.

QUESTION 2 IS CONTINGENT ON QUESTION 1, MEANING IT CAN ONLY PASS IF QUESTION 1 PASSES.

For more information on how these funds would be used, return to the District’s website.

Impact on Property Taxes

Approval of the ballot questions would result in a property tax increase beginning with taxes payable in 2024, and the debt service tax levies would remain in place for 20 years. To determine the estimated impact of the proposed ballot questions on your 2024 taxes, follow the instructions below or view sample property types and values here.

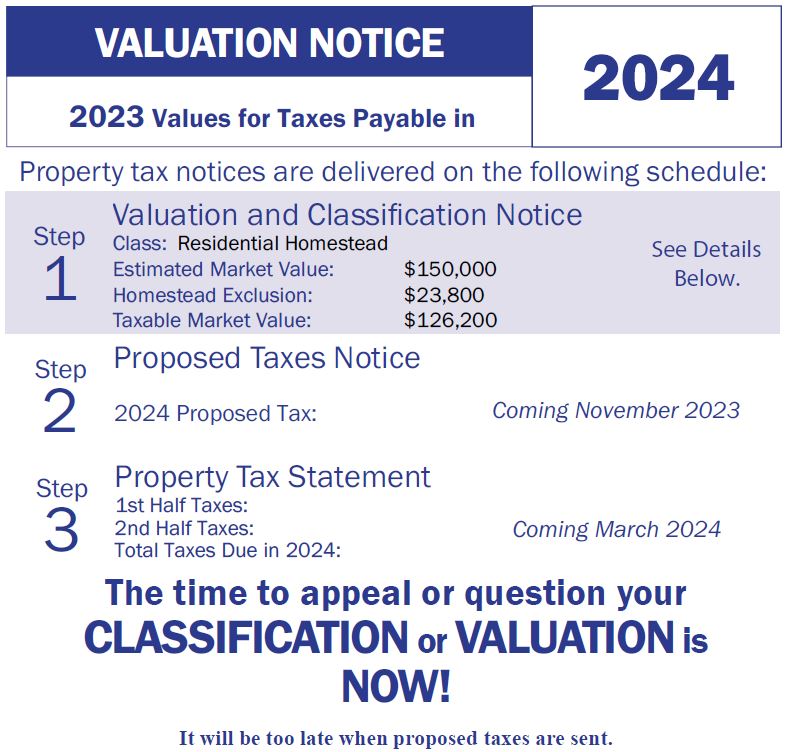

Your 2024 taxes will be based on the 2023 Estimated Market Value (EMV), which was provided on the Notice of Valuation and Classification mailed by your county in March 2023.

Click on the link below, accept the terms of the disclosure and click “proceed.” Enter in your search criteria and on the results screen click the parcel labeled as “2023 Value for Tax Payable 2024.” Click to view the “Value Information” tab and use the left-most value listed as “Total MKT” in the calculator below.

Click on the link below, accept the terms of the disclosure (need to allow pop-ups to see this screen) and enter in your search criteria. Select your parcel on the results screen and use the value listed as “EMV (Estimated Market Value) Total” under the “Valuation” section for Taxes Payable 2024 in the calculator below.

Click on the link below, accept the terms of the disclosure (need to allow pop-ups to see this screen) and enter in your search criteria. Select your parcel on the results screen and use the value listed as “Estimated Market Value” under the “Valuation” section for the 2023 Assessment in the calculator below.

ONLINE CALCULATORS: ESTIMATING TAX IMPACT

Residential Homestead Property

If you own a RESIDENTIAL HOMESTEAD property, enter the Estimated Market Value below to see the estimated tax impact.

Commercial / Industrial Property

If you own COMMERCIAL/INDUSTRIAL property, enter the Estimated Market Value below to see the estimated tax impact.

Agricultural Property

If you own agricultural or other types of property, please complete the following form and submit it to Ehlers. Once we receive it, an Ehlers representative will contact your county to find the value and classification of your property, calculate the tax impact and contact you via phone or email with the results. Please allow 1-3 days for completion. PLEASE NOTE: you may enter up to 10 property IDs by clicking the “+” button at the end of each row. For more than 10 properties, please contact Ehlers.

If you have any questions, please call Ehlers at 1-800-552-1171 and ask to speak with a member of our Education Team.

School Building Bond Agricultural Credit

This property tax credit originally took effect with property taxes payable in 2018. For taxes payable in 2023 and later, the credit reduces taxes for owners of agricultural property in an amount equivalent to 70% of the taxes attributable to school district debt service for all agricultural property, except for the house, garage, and one acre. This credit is directly deducted from property taxes owed and applies to debt service levies for all types of existing and future bonds for construction and renovation projects. The credit is paid through an open and standing appropriation, which means that no action by the Legislature is required each year for this credit to be paid from the state general fund. The credit is automatically deducted on the tax statement and is included in the tax impact estimates provided by Ehlers.

There are certain Minnesota Tax Credits and Deferrals that may affect certain property owners' situations. They include:

Minnesota Homestead Credit Refund

If your household income is less than approximately $128,280, you may qualify for the Homestead Credit Refund (also known as the Circuit Breaker refund). This program, which has existed since the 1970s, is intended to reduce tax burdens for homeowners with relatively low incomes and relatively high property tax burdens. Some important facts about this program are summarized below.

- Available each year to owners of homestead property

- Applies only to the taxes attributable to the house, garage, and one acre on agricultural homestead property

- Available to all owners of residential homestead and agricultural homestead property with household incomes of less than $128,280

- Refund is on a sliding scale, based on your income and your total property tax burden

- The maximum refund is $3,140

- Also available to renters

- To determine eligibility and refund amounts, complete Minnesota tax form M1PR

Special Property Tax Refund

If your total property taxes increase by more than 6 percent and more than $100 from one year to the next, you may qualify for a state refund equal to a portion of the increase. There is no income limit for this refund and the maximum refund is $2,500.

To determine eligibility and refund amounts, complete Minnesota tax form M1PR.

Senior Citizen Property Tax Deferral

If you are 65 years or older and have a household income of $96,000 or less, you may be eligible to defer a portion of the property taxes on your home, through the Senior Citizen Property Tax Deferral Program. The program:

- Limits the maximum amount of property tax you pay to 3 percent of your total household income

- Provides predictability; the amount of tax you pay will not change for as long as you participate in this program

The 2023 Legislature modified the requirements of this program by increasing the household income limit to $96,000. This new income limit is in effect for taxes payable in 2024 and later years.