Arbitrage 2.0: Strategies For The Spread

E-Quarterly Newsletter - September 2023 Quarterly Newsletter

by Aaron Bushberger, Municipal Advisor

and Brian Reilly, CFA, Senior Municipal Advisor | Managing Director

In our December quarterly newsletter, we highlighted the re-emergence of market conditions that enhance the potential for complications related to arbitrage for issuers of tax-advantaged debt.

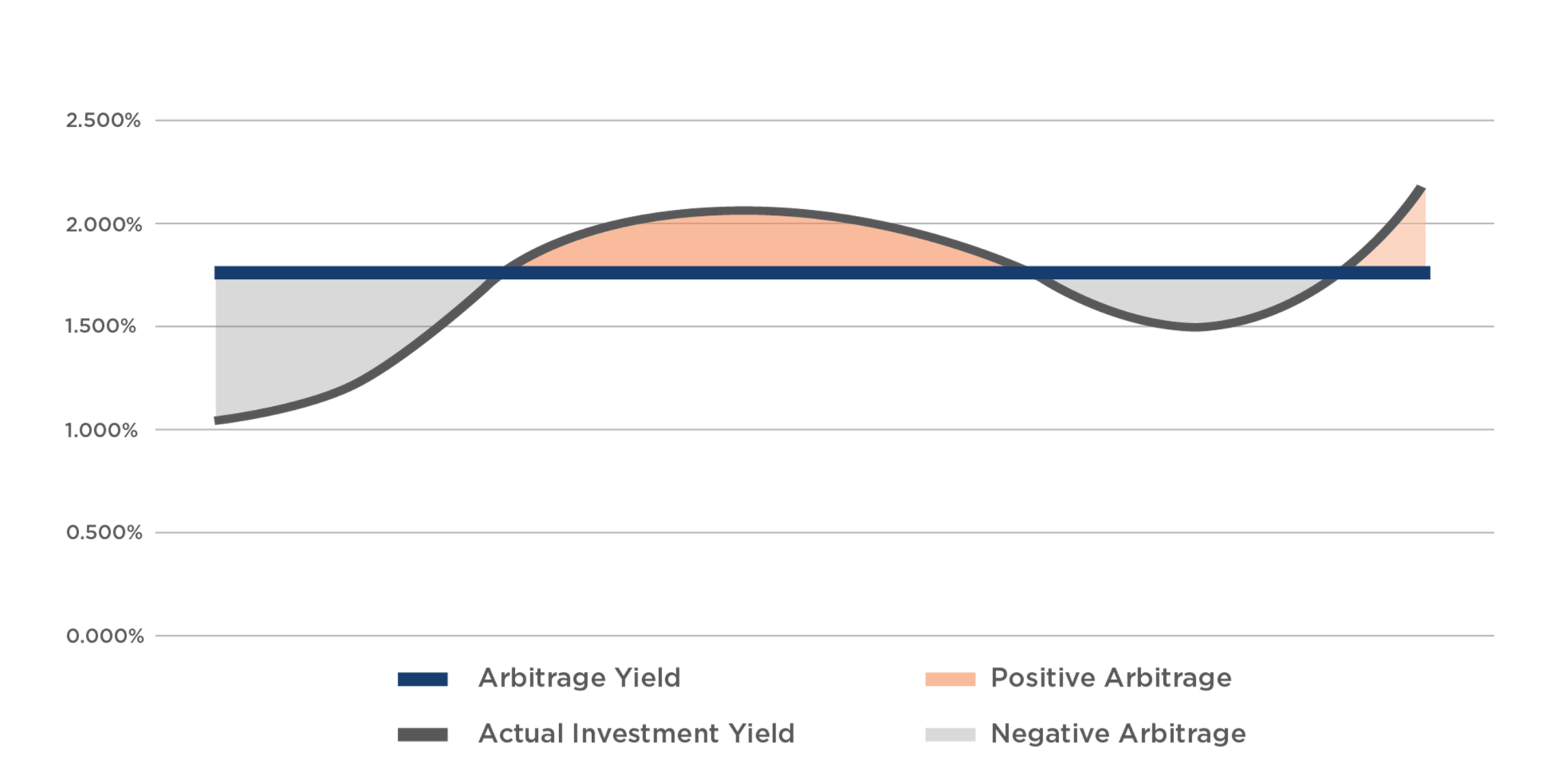

Arbitrage is the “spread” between the interest you pay on tax-exempt bonds and the interest you earn from investing proceeds of those bonds. If the spread is positive – that is, you’re earning more interest than you’re paying on the debt – the IRS generally requires that you rebate the difference to the federal government. In that article, we laid out a few practical steps to manage compliance with arbitrage rules, including establishing a finance plan that incorporates how bond funds are spent, invested, and monitored. Since that time, those conditions have only been exacerbated with the federal funds rate increasing nearly 1.25% since that time, and one- and two-year U.S. Treasury yields up roughly 75 basis points (0.75%). Tax-exempt borrowing rates are also higher than December of 2022, but not to the same degree.

Our December commentary also laid out some of the other factors unrelated to interest rates that are leading to increased interest earnings on borrowed proceeds and the related difficulties in meeting exceptions to arbitrage rebate. While things like construction delays associated with supply chain disruptions and labor availability have improved, schedules are still elongated compared to historical norms.

The specific spending exceptions applicable to rebate are as follows:

The exceptions apply to “gross proceeds,” which includes interest earnings. If you’re looking at your project draw schedule without interest earnings and identify the ability to qualify for the relevant exception looks tight, you might find yourself unable to meet those milestones. It’s also important to note that meeting a spending exception doesn’t exempt an issuer from the arbitrage rules. Those rules apply to all funds and accounts related to a tax-advantaged bond issue over the life of the debt (not just the construction fund), along with the yield restriction requirements.

The above commentary focuses largely on the investment side of the arbitrage equation. Given that market conditions have increased the likelihood of earning arbitrage, we’ve shifted our gaze to also include the debt side of the formula, most specifically with longer-duration construction projects (think school buildings, public works and treatment facilities, administrative buildings, etc.).

When we have been unable to establish a reasonable expectation that our clients’ tax-exempt debt issues can qualify for a spending exception to rebate, we have investigated the feasibility and potential risks around financing capital projects with a multi-series approach to debt issuance. The arbitrage rules apply at the issue level – not the project level – and spending exceptions are applied to each respective issue. Where a single issue to finance a project may present problems relative to meeting the spending exceptions, issuing two or more series of bonds over an extended period may alleviate those timing constraints.

When analyzing whether to pursue a multi-issue project financing plan, it’s critical to fully assess all associated pros and cons. For example, more debt issues result in higher costs of issuance, but that can be balanced out by interest earnings and more easily achieve Federal Tax Code compliance under the arbitrage rules. Another positive is the opportunity to span debt across calendar years and potentially enjoy bank qualification (issuing less than $10 million per calendar year) and/or small issuer status (annual tax-exempt debt no greater than $5 million for municipalities and $15 million for schools) for one or all of your issues. That said, issuing debt in tranches over time may introduce interest rate risk into the overall financing plan.

The key consideration here is to work closely with your advisory professionals – including bond counsel – to develop a financing plan that fully contemplates all aspects of your borrowing needs, investing opportunities and arbitrage compliance requirements. And do so early in the project planning process; it could mean the difference between maximizing the dollars available to fund your initiatives with the least amount of borrowing and writing a large arbitrage rebate check to the IRS. As always, Ehlers’ integrated team of municipal advisors, investment advisers and arbitrage consultants is here to help!

Required Disclosures: Please Read

Ehlers is the joint marketing name of the following affiliated businesses (collectively, the “Affiliates”): Ehlers & Associates, Inc. (“EA”), a municipal advisor registered with the Municipal Securities Rulemaking Board (“MSRB”) and the Securities and Exchange Commission (“SEC”); Ehlers Investment Partners, LLC (“EIP”), an investment adviser registered with the SEC; and Bond Trust Services Corporation (“BTS”), holder of a limited banking charter issued by the State of Minnesota.

This communication does not constitute an offer or solicitation for the purchase or sale of any investment (including without limitation, any municipal financial product, municipal security, or other security) or agreement with respect to any investment strategy or program. This communication is offered without charge to clients, friends, and prospective clients of the Affiliates as a source of general information about the services Ehlers provides. This communication is neither advice nor a recommendation by any Affiliate to any person with respect to any municipal financial product, municipal security, or other security, as such terms are defined pursuant to Section 15B of the Exchange Act of 1934 and rules of the MSRB. This communication does not constitute investment advice by any Affiliate that purports to meet the objectives or needs of any person pursuant to the Investment Advisers Act of 1940 or applicable state law. In providing this information, The Affiliates are not acting as an advisor to you and do not owe you a fiduciary duty pursuant to Section 15B of the Securities Exchange Act of 1934. You should discuss the information contained herein with any and all internal or external advisors and experts you deem appropriate before acting on the information.