Getting the Job Done

E-Quarterly Newsletter - December 2022 Quarterly Newsletter

By Greg Johnson, Senior Municipal Advisor

and Jonathan Schatz, Municipal Advisor

Completing Capital Projects in a Rising Interest Rate Environment

It’s an immutable fact: capital assets are fundamental to the nature of almost all governmental entities. Even as the world evolves to different delivery and social models to live, work, learn, and play. Our governmental jurisdictions will still need to construct, equip, maintain, and operate the physical assets that underpin our society.

When we think about the traditional means by which many of these capital assets are funded, there are really two primary drivers of their total cost (setting aside operational expenses for the moment) – the actual costs of constructing these assets and the cost of capital in the form of interest expense. It’s true that many governmental entities finance the cost of generational assets in the form of debt, which is often amortized over periods up to twenty years or more. There are both philosophical and economic reasons for using debt. Those that have the benefit of the asset pay for it over its useful life, and it can be difficult to accumulate enough cash to pay for projects using 100% equity financing. Further, even if one governing body sets out on a strategy of building cash reserves to pay for projects, future boards/councils cannot be bound by those prior decisions.

If we contemplate about the “true” cost of capital projects, then today’s environment could be considered one of the most challenging in recent history for elected and administrative officials. It’s no secret that the cost of everything is up. In this case “up” can vary greatly depending on what you’re referring to. While common measures of inflation might point to cost increases in the range of 10%, or more, some materials costs having increased anywhere from 30% – 100% in the last few years. The costs of labor, fuel, and the other core aspects of mobilizing and constructing buildings and infrastructure aren’t far behind. If that isn’t enough, the cost of capital in the form of interest rates has also increased materially.

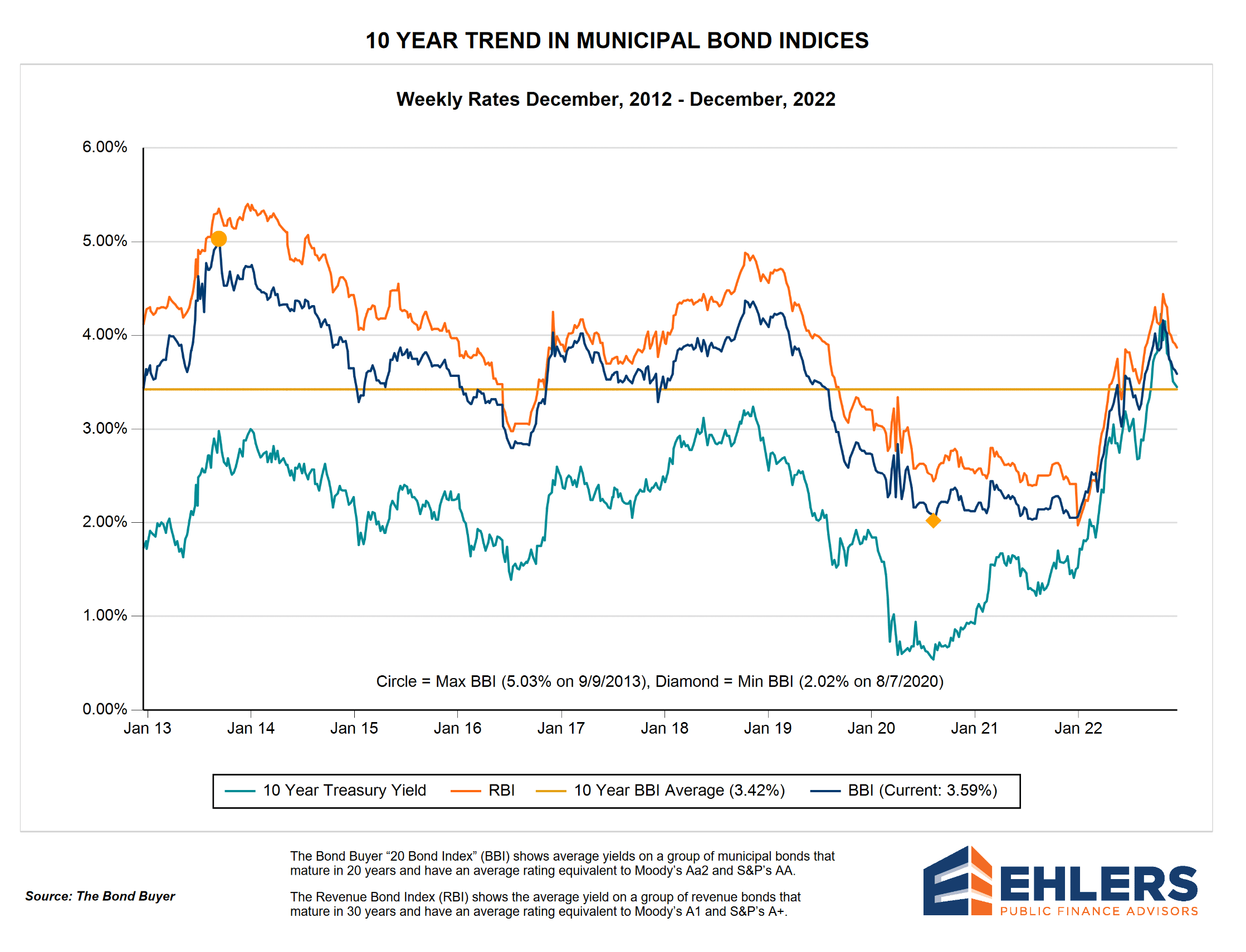

Since the beginning of the calendar year, some of the most widely tracked benchmarks for municipal borrowing have increased approximately 2.00%. That number isn’t altogether striking until it’s put in the context of the rapidity of the rise in rates relative to where we started. During the last couple of years, it was not uncommon for highly rated municipal borrowers to achieve 20-year financing rates less than or close to 2.00%, so it’s not hyperbole to state borrowing costs have roughly doubled in the last year for many. However, if we take a breath and a big step back, perhaps we might realize that those periods of ultra-low rates were the anomaly, rather than the norm. The following chart shows two common indices associated with long-term borrowing costs for municipal issuers, as well as the 10-year U.S. Treasury. The straight line is the average of what could be considered general obligation borrowing over the last 10 years. While the cost of capital is certainly higher than its nadir in mid-2020, it’s still near the average of the last decade and would be considered low if we expanded our view to 20 years.

Reassessing Operating and Capital Budgets in Challenging Times

We get it – everything in your budget costs more and it can be daunting to rationalize how to achieve your goals, knowing that your constituents ultimately bear the burden. It’s easy to demure in the face of this challenge, pushing projects and the decisions related to them to the future – perhaps even the next board or council. However, that course of action doesn’t fix the streets, secure equipment to provide for public safety services, or expand or replace aging facilities to accommodate your growing student base or population. In fact, choosing to delay may end up costing more in the long run. Band-aids on aging infrastructure can have short useful lives and can sometimes be good money chasing bad. Being good stewards of resources entails making difficult decisions, but good information and a long-term perspective can provide confidence in these challenging times.

Long-term planning is the method by which effective organizations build consensus, achieve objectives, and communicate their strategy and spending priorities to the public. A long-term financial plan should incorporate all aspects of your budget, including both operational and capital expenditures, over a five-to-ten-year horizon. Do you have a Capital Improvement Plan (CIP)? If so, when is the last time it was updated? Ideally it should be rolled over and extended every year with at least a five-year outlook. If you don’t presently have one, there’s no better time to start than now. What are your organization’s operational and personnel needs over the next five years? What are your current and future resources to fund these expenditures? What are the impacts to your constituents and are there various ways to mitigate those potential impacts?

A long-term financial management plan will provide these answers and give administrative and elected officials the ability to review different funding scenarios to make strategic decisions today that provide a feasible path toward the future. In the process, you will have communicated your vision to the public and gained an understanding of the outcomes associated with that vision. Having said all that, understand that your “Plan” is a living document that requires constant vigilance. Assumptions should be revisited every year and the plan updated to ensure your lens into the future isn’t clouded by uncertainty.

The Show Must Go On

Our governmental institutions are intended to be perpetual. Short-term thinking and a reactive stance often result in myopic and costly decision making that can compound over longer periods of time. Information, process, and a steady hand are the tools of prudent judgement and leadership. Elected officials can rely on their staff and the professionals they work with to synthesize and distill what otherwise seems to be a disparate mosaic of data and assumptions that can help drive discussion, engagement with your constituents, and a feasible approach to achieving a vision for the future built on a foundation of confidence.

There is only one certainty – there will always be uncertainty. We should all endeavor to cut through that fog and do the hard work we have been tasked with that will pave the way for generations to come.

Required Disclosures: Please Read

Ehlers is the joint marketing name of the following affiliated businesses (collectively, the “Affiliates”): Ehlers & Associates, Inc. (“EA”), a municipal advisor registered with the Municipal Securities Rulemaking Board (“MSRB”) and the Securities and Exchange Commission (“SEC”); Ehlers Investment Partners, LLC (“EIP”), an investment adviser registered with the SEC; and Bond Trust Services Corporation (“BTS”), holder of a limited banking charter issued by the State of Minnesota.

This communication does not constitute an offer or solicitation for the purchase or sale of any investment (including without limitation, any municipal financial product, municipal security, or other security) or agreement with respect to any investment strategy or program. This communication is offered without charge to clients, friends, and prospective clients of the Affiliates as a source of general information about the services Ehlers provides. This communication is neither advice nor a recommendation by any Affiliate to any person with respect to any municipal financial product, municipal security, or other security, as such terms are defined pursuant to Section 15B of the Exchange Act of 1934 and rules of the MSRB. This communication does not constitute investment advice by any Affiliate that purports to meet the objectives or needs of any person pursuant to the Investment Advisers Act of 1940 or applicable state law. In providing this information, The Affiliates are not acting as an advisor to you and do not owe you a fiduciary duty pursuant to Section 15B of the Securities Exchange Act of 1934. You should discuss the information contained herein with any and all internal or external advisors and experts you deem appropriate before acting on the information.