It’s Complicated!

E-Quarterly Newsletter - March 2024

By Stacie Kvilvang, Senior Municipal Advisor

Clarifying Minnesota’s New TIF Legislation

In 2023, Governor Walz signed into law a number of changes to the existing TIF statute that:

- Align and clarify how practitioners have historically implemented TIF law

- Clarify pooling calculations

- Adjust the Year-Six Rule to clarify how it’s calculated, and add parcel removal requirements

As municipalities begin to implement these legislative updates, there are three key takeaways:

- The definition of administrative costs was amended to include a specific list of allowable expenditures for the creation and management of a TIF district. While TIF practitioners typically included many of these expenditures before the new law was enacted, there is now certainty as to which items can legally be used. Of particular note is #5 in the chart below, which codifies that cities may use TIF to pay for the typical costs of owning property (i.e., lawn care, snow removal, monthly utilities) while waiting to either demolish it or sell to a private entity. Other allowable expenditures include:

- Pooling calculations were clarified to specifically state:

-

- County costs (administrative & roads) must be deducted prior to calculating the pooling percentage

- Administrative costs are considered expended within the TIF district if all pooling for the district was for affordable housing (allowing more dollars for pooling for affordable housing)

- What TIF Revenue amount may be used to calculate the pooling percentage of a given district as noted below (applies only to districts that decertify after December 31, 2023)

- The Year-Six Rule, which requires municipalities to decertify a TIF district when sufficient revenue exists to pay off obligations, was largely rewritten to clarify how to calculate when sufficient TIF has been received. It also now requires that parcels not pledged to a PAYGO note, bonds or interfund loan:

-

- Be decertified from the district by the end of the year – OR –

- Use the applicable in-district revenue from those parcels to prepay obligations – OR –

- Accumulate revenue if a city has elected to retain an additional 10% for affordable housing

Cities are required to remove parcels via a modification of the TIF plan prior to the end of the calendar year in which the above conditions have been satisfied and the modification does not require a public hearing. If TIF was pledged to bonds financing projects outside of the district prior to August 1, 2023, the requirement to remove parcels does not apply.

It’s important for cities to remember that the Year-Six Rule does NOT apply to housing districts and likely will never come into play for economic development districts or small renovation and renewal or redevelopment districts where all parcels are developed, and the city is providing more than 75% of TIF generated to the project(s).

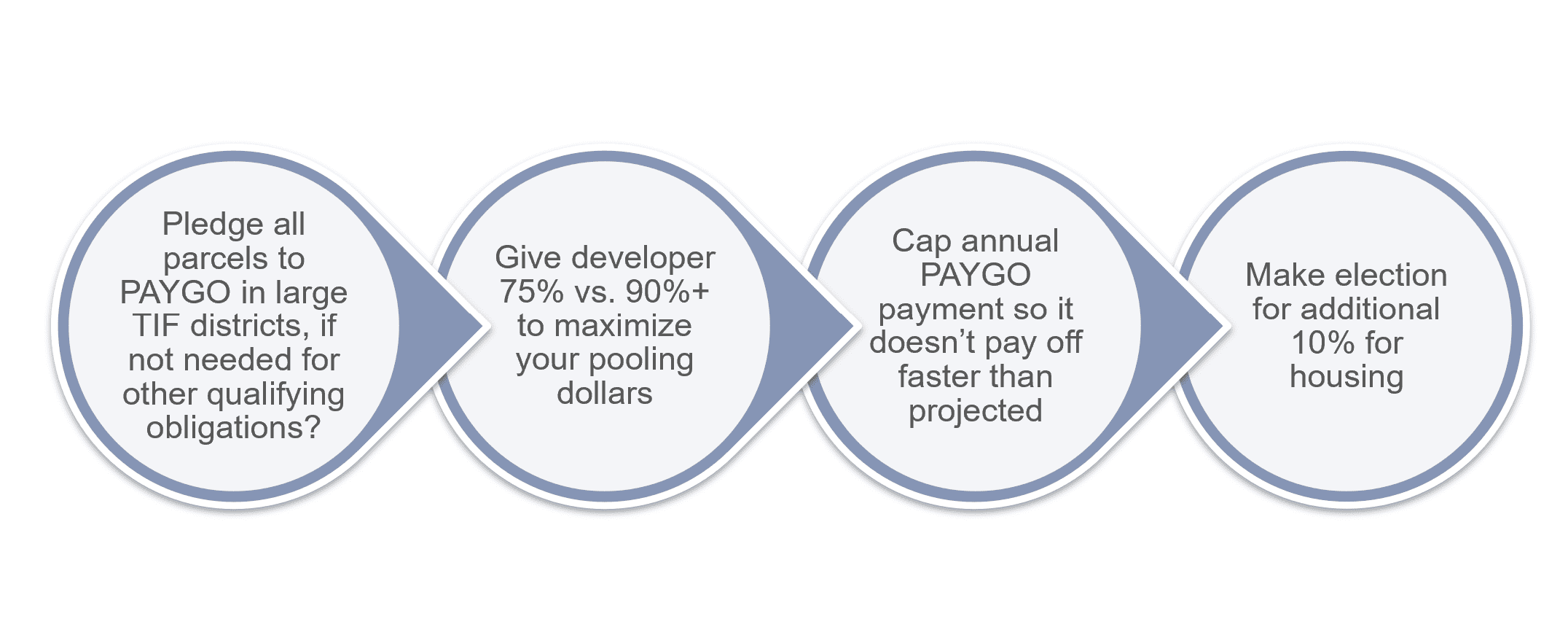

As cities seek to manage their non-housing districts to achieve various financial objectives while working within the parameters of this new legislation, they may want to consider the following allowable actions:

TIF still remains somewhat complicated in terms of compliance with all the rules, so be sure to reach out to your municipal advisor or TIF attorney for guidance to properly manage your district(s).

TIF still remains somewhat complicated in terms of compliance with all the rules, so be sure to reach out to your municipal advisor or TIF attorney for guidance to properly manage your district(s).

Want to learn more? See our TIF Law Update presentation given in conjunction with Kennedy & Graven, Charted.

Important Disclosures:

Ehlers is the joint marketing name of the following affiliated businesses (collectively, the “Affiliates”): Ehlers & Associates, Inc. (“EA”), a municipal advisor registered with the Municipal Securities Rulemaking Board (“MSRB”) and the Securities and Exchange Commission (“SEC”); Ehlers Investment Partners, LLC (“EIP”), an SEC registered investment adviser; and Bond Trust Services Corporation (“BTS”), holder of a limited banking charter issued by the State of Minnesota.

Where an activity requires registration as a municipal advisor pursuant to Section 15B of the Exchange Act of 1934 (Financial Management Planning and Debt Issuance & Management), such activity is or will be performed by EA; where an activity requires registration as an investment adviser pursuant to the Investment Advisers Act of 1940 (Investments and Treasury Management), such activity is or will be performed by EIP; and where an activity requires licensing as a bank pursuant to applicable state law (paying agent services shown under Debt Issuance & Management), such activity is or will be performed by BTS. Activities not requiring registration may be performed by any Affiliate.

This communication does not constitute an offer or solicitation for the purchase or sale of any investment (including without limitation, any municipal financial product, municipal security, or other security) or agreement with respect to any investment strategy or program. This communication is offered without charge to clients, friends, and prospective clients of the Affiliates as a source of general information about the services Ehlers provides. This communication is neither advice nor a recommendation by any Affiliate to any person with respect to any municipal financial product, municipal security, or other security, as such terms are defined pursuant to Section 15B of the Exchange Act of 1934 and rules of the MSRB. This communication does not constitute investment advice by any Affiliate that purports to meet the objectives or needs of any person pursuant to the Investment Advisers Act of 1940 or applicable state law.