Wisconsin Covered Services: Essentials for Municipal Leaders

E-Quarterly Newsletter - December 2025

By Harry Allen, Senior Municipal Advisor

and Sean Lentz, Senior Municipal Advisor

Levy limit referendums have become a critical tool for Wisconsin municipalities seeking solutions for budgetary constraints. These referendums allow local governments to exceed state-imposed levy limits, but because they are proving difficult to get approved, communities are often forced to simultaneously consider alternative solutions. The 2024 election cycle underscored these challenges with some key results:

- Average yes vote percentage: 45%

- Success rate: 46% (6 of 13 levy limit referendums passed)

- Public safety-focused questions had an average yes vote percentage of 48% while funding ongoing operations had one of the lowest at 39%.

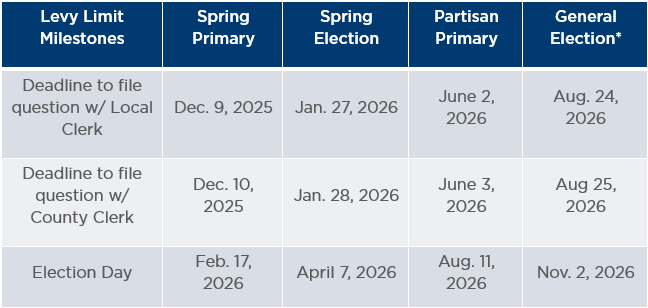

Municipalities considering a referendum must navigate strict filing deadlines and election schedules. Below are the critical deadlines for the four 2026 elections:

NOTE: For November elections, certified Net New Construction (NNC) values must be used, not estimates. Since certification occurs August 15, municipalities have just 10 days to finalize calculations, draft the question, and secure governing body approval…a tight turnaround.

Given the continued challenges of achieving a successful levy limit referendum, it is important to understand what other revenue flexibility exists. One such solution may be introducing new municipal fees. However, the state legislature will not allow all fee-based changes to proceed without a corresponding reduction in levy. The legislature has defined certain government services as “covered services” which require levy reductions to enact a partial or complete fee-based model. This does not eliminate the potential benefit of moving to fee-based model, but it requires further research to ensure it will be a net benefit to your community’s ability to continue providing critical services.

Understanding Covered Services & Negative Adjustments

Wisconsin law requires municipalities to reduce their levy limit when implementing user fees for certain “covered services” if the user fee was put into place on or after July 2, 2013. They include:

- Garbage collection (excluding recycling)

- Fire protection (excluding public fire protection charge)

- Snow plowing

- Street sweeping

- Stormwater management

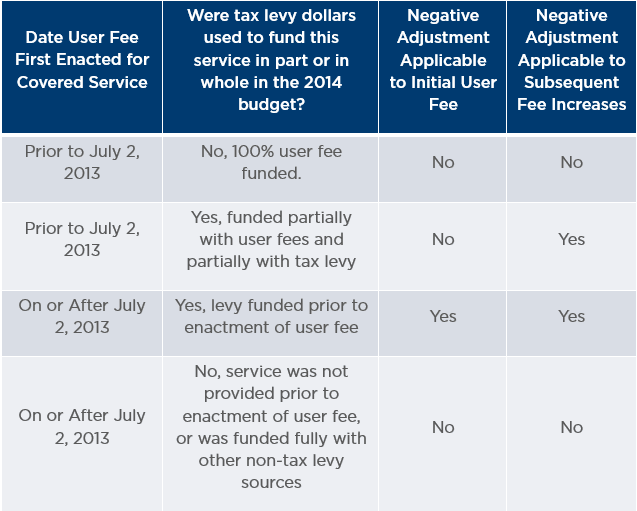

It must also be the case that the service for which the user fee is implemented was funded in whole or in part by the 2013 tax levy for the 2014 budget year. The negative adjustment equals projected revenue from the new or increased fee, capped at the amount of levy support provided for that service in the 2013 budget for the 2014 fiscal year. Note that while the negative adjustment applies in the case of a fee increase (subject to the negative adjustment cap), it does not apply if revenues increase because of additional service units without a fee change. The following table provides additional clarification based on the four possible scenarios:

On the surface, this may seem like a detriment to your municipal budget given the negative impact to the levy. However, the negative adjustment cap is key as costs for these services have risen significantly since 2014 thus making its impact far less significant today (i.e. the original levy support is likely much lower than current service costs). This allows municipalities to generate additional revenue through user fees and continue adjusting them over time to keep pace with rising expenses without being constrained by levy limit restrictions.

PRACTICAL EXAMPLE: THE VILLAGE OF COTTAGE GROVE

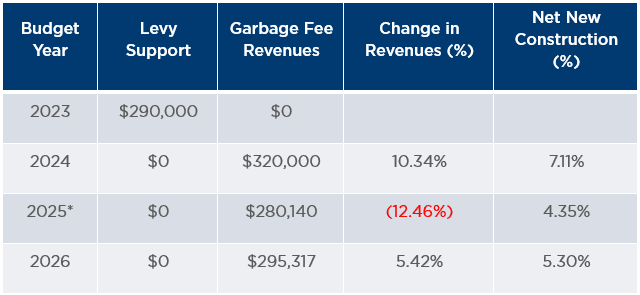

Cottage Grove offers a real-world example of how these rules play out. The Village implemented a garbage collection fee starting with the 2024 budget which resulted in a $224,000 negative adjustment on its levy limit worksheet. However, at the same time, the Village set the fees to cover the total cost of the service of $320,000 resulting in a net increase of revenues of $96,000. Here’s how the numbers have evolved:

NOTE: The 2025 decrease reflects a switch to a lower-cost provider causing a subsequent reduction in fees.

THE BOTTOM LINE

Bottom line, levy limit referendums will continue to be necessary across the state but given the approval margins, municipalities must take a broader look at solutions for generating necessary revenues. A fee-based approach is one such solution, but particular attention needs to be paid if the fee is for one of the “covered services.” Instituting fees for “covered services” may still be a net positive even with the negative levy impact and the cap on the levy reduction means the negative hit becomes less significant year after year.

Important Disclosures: Please Read

Ehlers is the joint marketing name of the following affiliated businesses (collectively, the “Affiliates”): Ehlers & Associates, Inc. (“EA”), a municipal advisor registered with the Municipal Securities Rulemaking Board (“MSRB”) and the Securities and Exchange Commission (“SEC”); Ehlers Investment Partners, LLC (“EIP”), an investment adviser registered with the SEC; and Bond Trust Services Corporation (“BTS”), holder of a limited banking charter issued by the State of Minnesota.

This communication does not constitute an offer or solicitation for the purchase or sale of any investment (including without limitation, any municipal financial product, municipal security, or other security) or agreement with respect to any investment strategy or program. This communication is offered without charge to clients, friends, and prospective clients of the Affiliates as a source of general information about the services Ehlers provides. This communication is neither advice nor a recommendation by any Affiliate to any person with respect to any municipal financial product, municipal security, or other security, as such terms are defined pursuant to Section 15B of the Exchange Act of 1934 and rules of the MSRB. This communication does not constitute investment advice by any Affiliate that purports to meet the objectives or needs of any person pursuant to the Investment Advisers Act of 1940 or applicable state law. In providing this information, The Affiliates are not acting as an advisor to you and do not owe you a fiduciary duty pursuant to Section 15B of the Securities Exchange Act of 1934. You should discuss the information contained herein with any and all internal or external advisors and experts you deem appropriate before acting on the information.