Persistent Inflation and Economic Stabilization Might be Forcing Fed’s Hand

The Department of Labor released last month’s inflation data, which showed that growth in typical household expenditures, as measured by the Consumer Price Index (CPI), increased by 5.4% year-over-year in September. This continues the trend seen of concerning inflation data throughout the summer, which Federal Reserve officials heretofore have largely been describing as “transitory.”

As previously discussed in this Commentary, the Fed’s two major monetary stimulus responses to the Covid-19 pandemic were (1) reducing the target fed funds rate to a range of 0.00% – 0.25%, and (2) purchasing certain fixed-income securities, both of which meant to support financial markets and the economy by easing the transmission and cost of credit. Market watchers continue to observe for signals that the Fed will begin to remove or reduce these stimulative policies. The minutes from the September 21-22 meeting of the Federal Open Market Committee (FOMC) and Federal Reserve Board of Governors were released this week, revealing a proposed plan for tapering the asset purchase program. If implemented, the Fed will reduce the dollar amount of monthly asset purchases from the current level of $120 billion by $15 billion per month ($10 billion of US Treasuries and $5 billion of agency mortgage-backed securities), beginning mid-November or mid-December of this year and concluding around July 2022. The minutes showed a consensus of FOMC members believe that tighter monetary policy is warranted in the near term, as data show that inflation has persistently been at a level higher than the Fed’s target of 2% and has maintained that higher level for longer than anticipated. To be clear, no actual decision has been made to begin reducing asset purchases, which will need to be approved by the FOMC at a subsequent meeting, the next being November 2-3.

The minutes also show a discussion about increasing the target range for the fed funds rate. It was made clear at this meeting that the Fed would not move to increase the fed funds target rate range until it had completely ended its asset purchasing. This is consistent with prior messaging from Fed officials that any increases to the fed funds rate would likely follow significant reduction in or elimination of the asset purchase program.

Trends in Municipal Markets

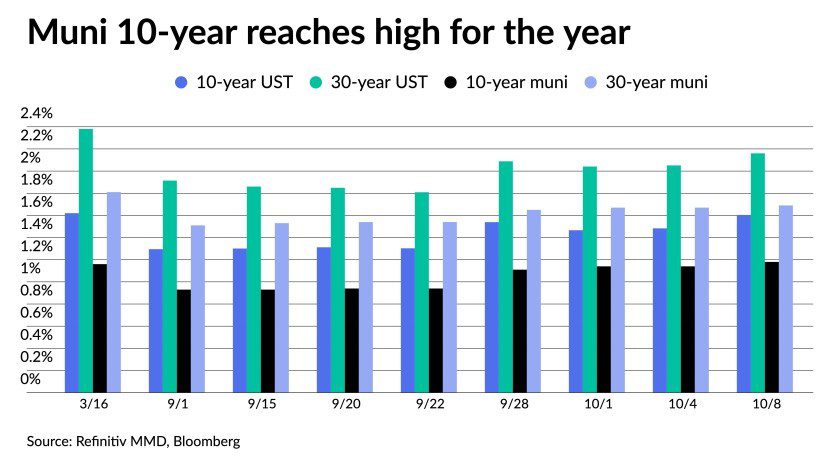

The municipal markets continue to experience a dearth of new issue volume, although demand has ebbed some in the face of some volatility in interest rates. Indexes have remained mostly flat this week, following a 2021 peak for the 10-year AAA-rated muni bond yield (1.18%), according to Refinitiv MMD. The 10-year muni-US treasury ratio was at 76% midway through this week, a small increase from last week but still below the 2017-2019 average of 81%.

The chart above shows how muni and US treasury yields have fluctuated, starting at the most recent peak (the March 2021 sell off) into October of this year. The 10-year muni benchmark has edged up slightly since September 28th, while 10-year and 30-year treasuries have been a bit more volatile.

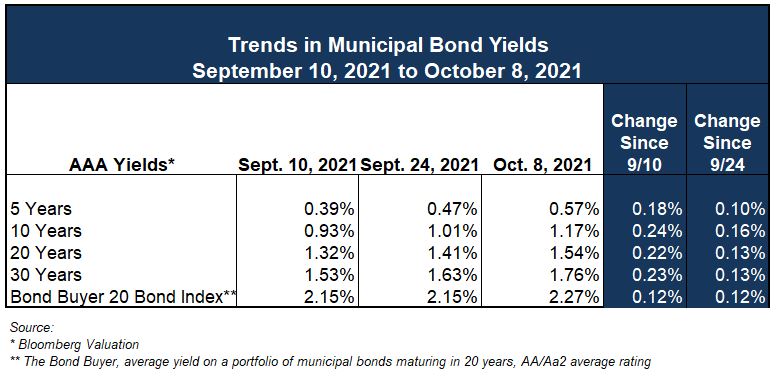

This week’s table (above) on muni yield trends shows that AAA-rated munis across the yield curve have increased over the past month, with 10-, 20-, and 30-year yields jumping up over 20 basis points (1 basis point = 0.01%) each during this period. Better than half of the increase in AAA-rated yields have come in the past week, according to Bloomberg Valuation. However, the Bond Buyer 20 Bond Index, which looks at a portfolio of munis with an average rating of AA/Aa2 shows a much less dramatic increase, except for the past week with the yield for this widely-tracked benchmark rising 12 basis points.

GFOA Releases New Guidance on Voluntary Disclosures and ESG

ESG (Environmental, Social and Governance) is an investment category that has gained considerable notoriety in the past decade, attracting significant amounts of capital through mandates. A growing cohort of investors in corporate stocks and bonds often weigh their investment decisions at least partially based on the degree to which the company has outlined their ESG policies and capital allocation activities. This paradigm has migrated to municipal investments, and the Government Finance Officers Association (GFOA) has put forward some guidance on how issuers of municipal debt can go about communicating their ESG principles with respect to their organization and bond-financed projects to existing and potential investors, either in a Preliminary Official Statement or through voluntary disclosure practices. Specifically, the best practices include “organizational structure, legal authority to issue debt, policy transparency, and management and policy frameworks” as potential governance-related details that could be disclosed, going forward (The Bond Buyer). GFOA states that some or all of this may already be included within primary offering documents, but as these factors are now being categorized under the ESG umbrella, issuers should take time to verify that they are included, if appropriate.

The key takeaway for municipal issuers from this new best practice is: “This enhanced communication and improved relations with investors can become an important factor for access to the capital markets, but more importantly should result in additional demand for its bond offerings that may lead to a lower cost of capital with more favorable terms” (GFOA).

Municipal issuers should take care in their disclosures related to outstanding securities, as well as crafting policies and procedures related to those efforts. Ehlers and our team of experts are ready to assist your organization contemplate this important aspect of your debt administration.

https://www.gfoa.org/materials/esg-best-practice-g-governance

Required Disclosures: Please Read

Ehlers is the joint marketing name of the following affiliated businesses (collectively, the “Affiliates”): Ehlers & Associates, Inc. (“EA”), a municipal advisor registered with the Municipal Securities Rulemaking Board (“MSRB”) and the Securities and Exchange Commission (“SEC”); Ehlers Investment Partners, LLC (“EIP”), an investment adviser registered with the SEC; and Bond Trust Services Corporation (“BTS”), holder of a limited banking charter issued by the State of Minnesota.

This communication does not constitute an offer or solicitation for the purchase or sale of any investment (including without limitation, any municipal financial product, municipal security, or other security) or agreement with respect to any investment strategy or program. This communication is offered without charge to clients, friends, and prospective clients of the Affiliates as a source of general information about the services Ehlers provides. This communication is neither advice nor a recommendation by any Affiliate to any person with respect to any municipal financial product, municipal security, or other security, as such terms are defined pursuant to Section 15B of the Exchange Act of 1934 and rules of the MSRB. This communication does not constitute investment advice by any Affiliate that purports to meet the objectives or needs of any person pursuant to the Investment Advisers Act of 1940 or applicable state law. In providing this information, The Affiliates are not acting as an advisor to you and do not owe you a fiduciary duty pursuant to Section 15B of the Securities Exchange Act of 1934. You should discuss the information contained herein with any and all internal or external advisors and experts you deem appropriate before acting on the information.