This site provides information for taxpayers of Independent School District 535 – Rochester, regarding how the district’s proposed capital project levy may affect property taxes. The site was prepared in cooperation with Ehlers, the district’s independent municipal advisor. If you have questions about the information on this site, please contact Ehlers using the information provided below.

This site provides information for taxpayers of Independent School District 535 – Rochester, regarding how the district’s proposed capital project levy may affect property taxes. The site was prepared in cooperation with Ehlers, the district’s independent municipal advisor. If you have questions about the information on this site, please contact Ehlers using the information provided below.

About the Referendum

The district will hold a special election on Tuesday, November 7, 2023 seeking voter approval of one ballot question.

QUESTION 1 proposes a capital project levy authorization of 4.467% times the net tax capacity of the school district. The revenue from the capital levy authorization will be used to provide funds for provide funds for the purchase, installation, support, and maintenance of software and technology equipment.

For more information on how these funds would be used, view the District’s website.

Impact on Property Taxes

Approval of the Capital Project Levy ballot question would raise approximately $10,150,000 for taxes payable in 2024, the first year it is to be levied, and will be authorized for ten (10) years. The estimated total cost of the projects to be funded over that time period is approximately $101,500,000.

To determine the estimated impact of the proposed ballot question on your 2024 taxes, follow the instructions below or view sample property types and values here.

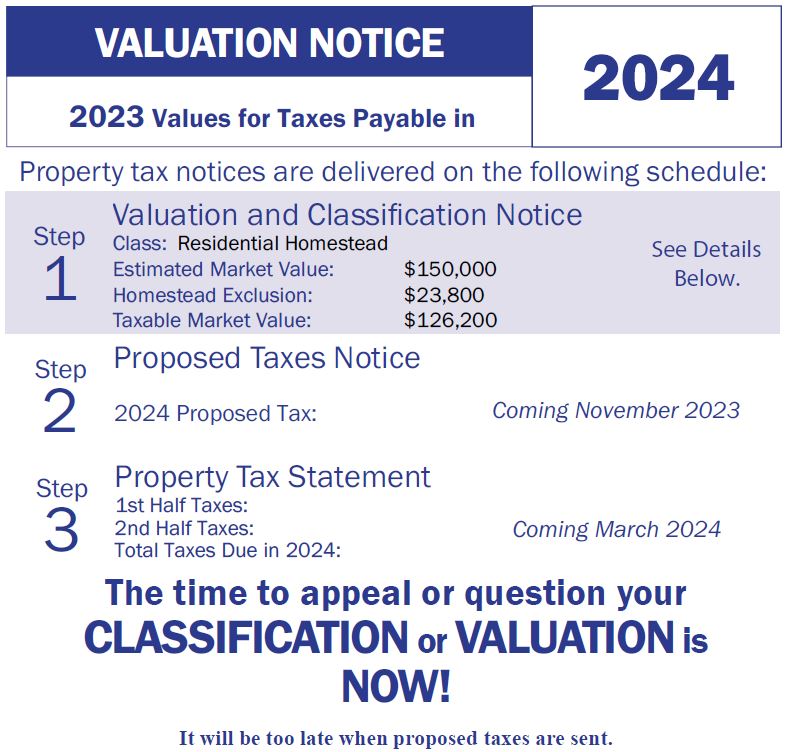

Your 2024 taxes will be based on the 2023 Estimated Market Value (EMV), which was provided on the Notice of Valuation and Classification mailed by your county in March 2023.

Click on the link below, select, “Agree” on the disclaimer and then enter in your search criteria on the next screen (make sure to change the “Asmt Year” to 2023 before selecting, “Search”. Select your parcel from the search results screen and under the “Reports” section (found on the right hand side of your screen), select “Notice of Valuation” and click “Go”. Use the number listed as, “Estimated Market Value” from the, “Step 1″ box in the calculator below.

Click on the link below, click “Agree” on the pop up (must allow pop ups to see this screen) and enter in your search criteria. Select your parcel from the results screen. Scroll down to the, “Valuation” section and use the value listed as, “Estimated Market Value” for the 2023 Assessment year in the calculator below.

ONLINE CALCULATORS: ESTIMATING TAX IMPACT

Residential Homestead Property

If you own a RESIDENTIAL HOMESTEAD property, enter the Estimated Market Value below to see the estimated tax impact.

Apartments & Residential Non-Homestead (2 or more units)

If you own APARTMENTS or RESIDENTIAL NON-HOMESTEAD property, enter the Estimated Market Value below to see the estimated tax impact

Commercial / Industrial Property

If you own COMMERCIAL/INDUSTRIAL property, enter the Estimated Market Value below to see the estimated tax impact.

There are certain Minnesota Tax Credits and Deferrals that may affect certain property owners' situations. They include:

Minnesota Homestead Credit Refund

If your household income is less than approximately $128,280, you may qualify for the Homestead Credit Refund (also known as the ‘Circuit Breaker’ refund). This program, which has existed since the 1970s, is intended to reduce tax burdens for homeowners with relatively low incomes and relatively high property tax burdens. Some important facts about this program are summarized below.

- Available each year to owners of homestead property

- Applies only to the taxes attributable to the house, garage, and one acre on agricultural homestead property

- Available to all owners of residential homestead and agricultural homestead property with household incomes of less than $128,280

- Refund is on a sliding scale, based on your income and your total property tax burden

- The maximum refund is $3,140

- Also available to renters

- To determine eligibility and refund amounts, complete Minnesota tax form M1PR

Special Property Tax Refund

If your total property taxes increase by more than 6 percent and more than $100 from one year to the next, you may qualify for a state refund equal to a portion of the increase. There is no income limit for this refund and the maximum refund is $2,500.

To determine eligibility and refund amounts, complete Minnesota tax form M1PR.

Senior Citizen Property Tax Deferral

If you are 65 years or older and have a household income of $96,000 or less, you may be eligible to defer a portion of the property taxes on your home, through the Senior Citizen Property Tax Deferral Program. The program:

- Limits the maximum amount of property tax you pay to 3 percent of your total household income

- Provides predictability; the amount of tax you pay will not change for as long as you participate in this program

The 2023 Legislature modified the requirements of this program by increasing the household income limit to $96,000. This new income limit is in effect for taxes payable in 2024 and later years.