Arbitrage is Back!

E-Quarterly Newsletter - December 2022 Quarterly Newsletter

By Stephen Broden

Senior Arbitrage Consultant | Managing Director

With New Opportunity Comes Strict Responsibility

It’s said that patience is a virtue. We could understand if those patiently waiting for higher investment rates had stopped holding their proverbial breath over the past decade, or so. Alas, that moment has finally arrived. Rising interest rates on investments are most certainly welcome. However, as is the case with most good things, a new set of challenges are introduced. For issuers of tax-exempt bonds, these challenges can largely be summed up in a single word: arbitrage.

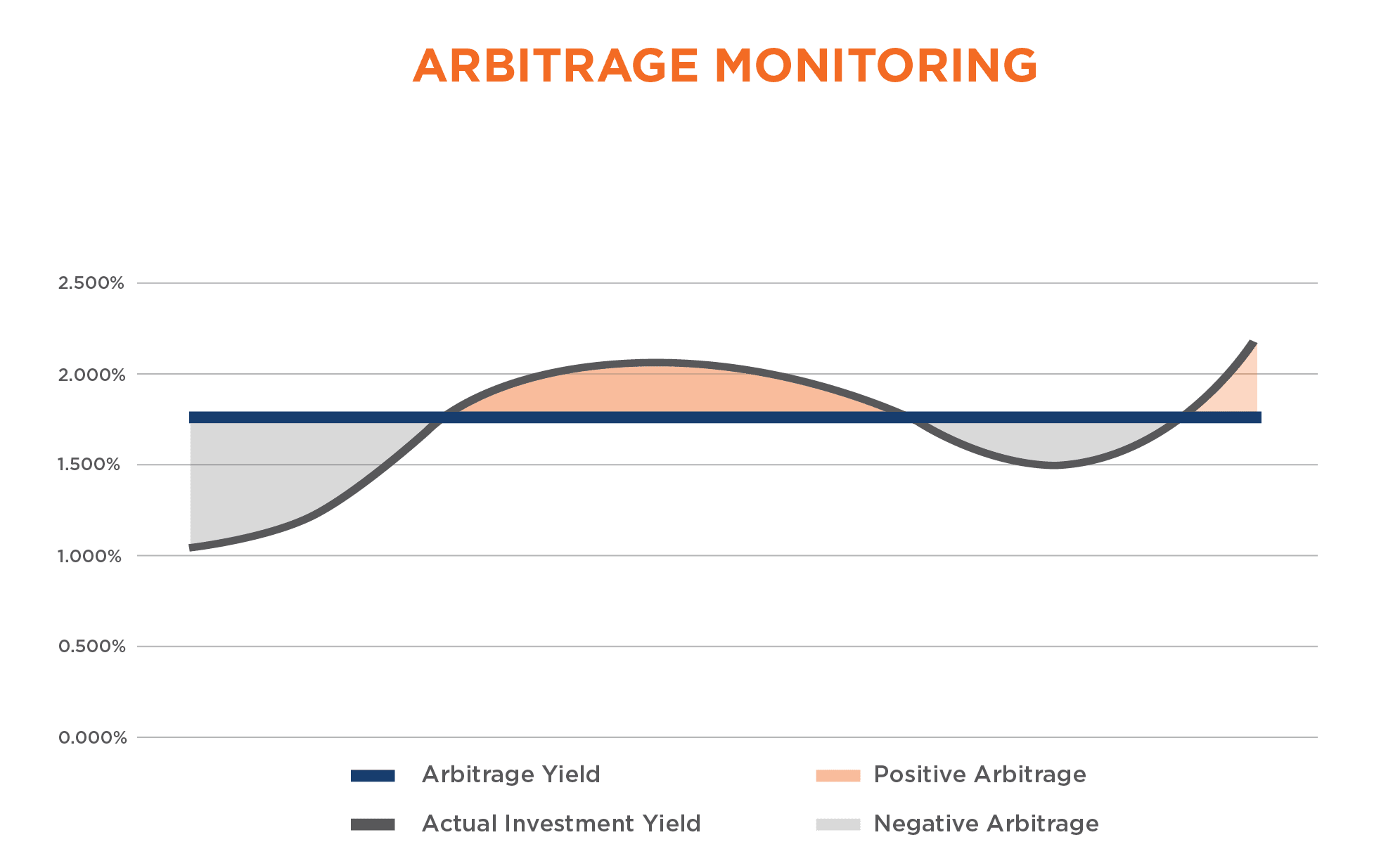

Arbitrage is the “spread” between the interest you pay on tax-exempt bonds and the interest you earn from investing bond proceeds as they are spent (as you’ll read later – arbitrage applies to all funds and accounts associated with tax-advantaged bonds). If this spread is positive – that is, you’re earning more interest than you’re paying on the debt – the IRS generally requires that you rebate the difference to the federal government.

The IRS cares about arbitrage because of the explicit subsidy associated with the federal tax exemption afforded governmental issuers, along with the fact those same issuers do not pay federal income tax on otherwise taxable securities they invest in. The U.S Treasury has a distinct interest in limiting the amount of tax revenue it is foregoing as a direct function of the tax-exempt bond market. Although many of the most common abuses related to arbitrage ended decades ago with the advent of the comprehensive arbitrage rebate regulations in 1986, the IRS still vigilantly monitors arbitrage and audits hundreds of issuers every year.

Bond proceeds are usually deposited in a project fund, debt service fund, a reserve fund, or some combination of the same. In addition, non-bond moneys set aside in the debt service fund for bond payments are considered bond proceeds. Unless your bond issue is taxable, all bond proceeds are subject to arbitrage. As interest rates rise these excess cash balances may earn investment yields higher than the bond yield, creating positive arbitrage. Positive arbitrage may need to be reported to and rebated to the IRS, depending on your situation, for the life of the bond issue.

There are certain exceptions that can exempt an issuer from remitting arbitrage payments to the IRS, most of which relate to meeting certain project spending milestones at specific intervals. Other exceptions relate to not exceeding thresholds in the funds and accounts associated with a tax-exempt bond issue, like the debt service and reserve funds. Reasonable expectations around meeting spending exceptions are typically set forth in the tax certificate or other documents executed at the time the bonds are sold and prior to settlement. For all tax-advantaged bonds, the issuer covenants that it will take affirmative steps to maintain the tax status of the bonds over the life of the issue for the benefit of bondholders.

The dynamics around arbitrage are presently complicated by circumstances many issuers haven’t encountered in some time (if ever):

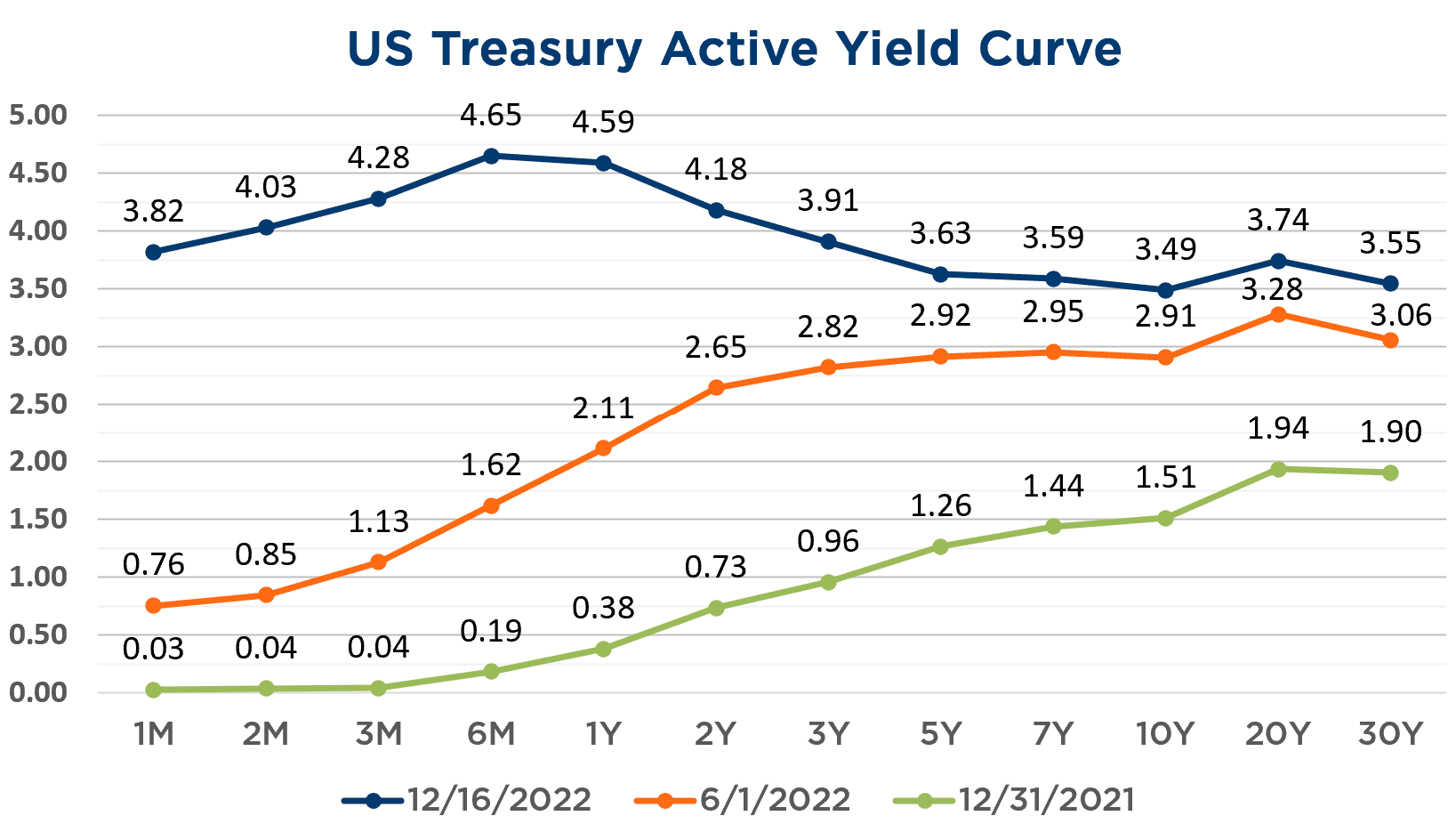

First, the “yield curve” is inverted. This means that short-term rates are higher than intermediate and long-term rates, which is exacerbated by the fact that tax-exempt borrowing costs are currently materially lower than taxable equivalent yields. As an example, a highly rated issuer can borrow 20-year money at perhaps 3.65%, then reinvest the proceeds at yields more than 4.50% for maturities as short as six months. Even most money market funds and cash equivalent investment products now yield close to 4.00%.

Second, project schedules are experiencing significant delays due to supply chain disruptions. These delays can result in not meeting the spending exceptions set forth in the arbitrage regulations, while also earning higher amounts of interest in the project fund. The combination of these two factors can manifest in an arbitrage liability unless remedial action is taken during the life of the project and during the period bond proceeds are invested. If not monitored appropriately, the issuer may find itself needing to remit an arbitrage payment to the IRS after having spent all project funds, including the interest earned.

Finally, the recently passed Inflation Reduction Act (IRA) included provisions to substantially increase staffing at the IRS. The IRS will now have more tax compliance resources at its disposal coincident with one of the only occasions in recent history where earning arbitrage is far more likely. It’s reasonable to expect random audits of tax-advantage bonds to increase over the next couple years as the Tax Exempt Bond division of the IRS staffs up and trains new hires.

Below are a few practical steps you can take to manage your arbitrage compliance:

Step 1: If your bond issue is subject to the arbitrage rebate or arbitrage yield restriction rules, establish a finance plan that incorporates how bond funds are spent, invested, and monitored.

For most governmental issuers, your bond issue is exempt from arbitrage rebate if the total amount of tax-exempt bonds issued in a calendar year is less than $5 million (the threshold is increased to $15 million for qualifying school districts). This is an annual test, so you may have some bond issues subject to the arbitrage rebate requirements while others are not, depending on your level of issuance in any given year.

Your bond issue is not exempt from arbitrage yield restriction as a result of the size, instead it is based on spending and investment expectations. There are exemptions for money spent during a “temporary period”, balance under a stated “de minimus” amount, or under an “allowable yield.”

In any event, monitoring project expenditures, investments, and investment income are now paramount tax compliance activities for all issuers. Surrounding yourself with qualified professionals to assist with tax compliance can also yield tangible benefits, given the complexity of tax regulations and the investment universe. Steps can be taken before and during the life of a bond issue to plan for and potentially mitigate the potential for rebate.

Step 2: Keep your funds segregated.

Keep your project fund, reserve fund and debt service funds separate and, if allowed by bond counsel, deposit capitalized interest in a restricted account in the project fund. Each fund has different compliance requirements and keeping funds segregated will reduce your cost of arbitrage compliance monitoring and the potential for major issues in the event the bonds are subject to audit.

We recognize the simplicity of commingling funds, but this simplicity could come at the cost of greater complexity and risk in the future.

Step 3: Spend your bond proceeds timely.

The IRS routinely audits issuers following the end of the first three years of a bond issue to find bonds with investments beyond the standard three-year temporary period. Be aware there are statutory constraints related to the potential for repurposing/redirecting the use of proceeds outside of the scope for which bonds were originally issued. Always consult with bond counsel and your financial advisor prior to considering any change in the spending plan or otherwise repurposing the use of proceeds for any debt.

If there are significant delays, your bond counsel can suggest ways to meet tax compliance obligations with your financial and investment advisors assisting with execution of that plan.

Step 4: Adjust deposits to the debt service fund at least annually.

Moneys in the debt service fund are subject to arbitrage – whether they come from tax levies, enterprise revenues or special assessments – once the average annual balance exceeds 108% of what is required to be paid out of the fund each year. The balance in the debt service fund should generally be exhausted each year to remain what is deemed “bona fide” status.

If the balance in the debt service fund (including interest earned) is not exhausted each year, adjustments should be made to the subsequent year’s deposits to the fund, which could include levying or appropriating an amount net of the excess balance, thus mitigating the chance of exceeding the limitations under the tax regulations.

Required Disclosures: Please Read

Ehlers is the joint marketing name of the following affiliated businesses (collectively, the “Affiliates”): Ehlers & Associates, Inc. (“EA”), a municipal advisor registered with the Municipal Securities Rulemaking Board (“MSRB”) and the Securities and Exchange Commission (“SEC”); Ehlers Investment Partners, LLC (“EIP”), an investment adviser registered with the SEC; and Bond Trust Services Corporation (“BTS”), holder of a limited banking charter issued by the State of Minnesota.

This communication does not constitute an offer or solicitation for the purchase or sale of any investment (including without limitation, any municipal financial product, municipal security, or other security) or agreement with respect to any investment strategy or program. This communication is offered without charge to clients, friends, and prospective clients of the Affiliates as a source of general information about the services Ehlers provides. This communication is neither advice nor a recommendation by any Affiliate to any person with respect to any municipal financial product, municipal security, or other security, as such terms are defined pursuant to Section 15B of the Exchange Act of 1934 and rules of the MSRB. This communication does not constitute investment advice by any Affiliate that purports to meet the objectives or needs of any person pursuant to the Investment Advisers Act of 1940 or applicable state law. In providing this information, The Affiliates are not acting as an advisor to you and do not owe you a fiduciary duty pursuant to Section 15B of the Securities Exchange Act of 1934. You should discuss the information contained herein with any and all internal or external advisors and experts you deem appropriate before acting on the information.