Development Due Diligence

E-Quarterly Newsletter - March 2023

By Greg Johnson, Senior Municipal Advisor

and Keith Dahl, Municipal Advisor

Best Practices for Tax Incremental Finance Districts

Municipalities across the country, just like every other sector of the economy in today’s environment, are burdened by rising costs. Operating budgets used to finance day-to-day operations, pay obligations, and maintain public infrastructure place upward pressure on property taxes. It’s now more important than ever for communities to scrutinize the application of tax increment financing (TIF) and implement best practices when establishing a tax increment district (TID) for private development. To reduce financial impacts, protect local resources and mitigate potential risk to communities, Ehlers recommends the following best practices:

Timing of Development & TID Investment

The mantra “if you build it, they will come” does not always hold true, especially in the wake of market uncertainty or an economic downturn. Prior to the housing market crash in 2007/2008, many municipalities created TIDs and issued debt to construct public infrastructure before any private development occurred. Many of these TIDs did not fare well compared to TIDs where capital investments matched the pace of private development. TIDs created as developments are proposed allows municipalities to manage certain aspects of risk, specifically timing of cash flows, primarily related to debt service obligations where there may be insufficient or even no tax increment revenues to pay for them.

In addition, matching TID creation and expenditures with the pace of development allows municipalities to pass along TID administrative costs to developers or whomever the applicant is requesting TIF assistance. Ehlers strongly encourages all municipalities to collect an escrow deposit from an applicant requesting TIF assistance. The escrow deposit should cover all attorney and consultant costs incurred as part of establishing a TID, drafting and negotiating a development agreement, and conducting any fiscal analysis that may be required to meet a community’s requirements for providing TIF assistance.

Generally, best practice is to create TIDs and make expenditures as requests are received and development commences. There are occasions where a community may consider establishing a TID and incurring expenses in advance of development, but detailed risk analysis in advance of those decisions is imperative.

Designing the District

Beyond satisfying statutory requirements, there are other factors to consider when establishing a Tax Increment District. Size is an important consideration when creating a district. Smaller or single parcel districts allow a development to stand on its own merits and makes incentive payment calculations simpler to administer. It also reduces the potential for value depreciation of the development or adjoining properties to negatively impact the overall performance of the TID.

Conversely, a larger district allows an initial catalyst project generating increment to support other initiatives. A district with immediate cash flow improves the likelihood of securing “spin-off” development – secondary development that occurs because of the initial development. Although if development occurs later in a larger district, there may be other obstacles to overcome. Bottom line – avoid including parcels unlikely to generate any increment and/or have the potential to depreciate.

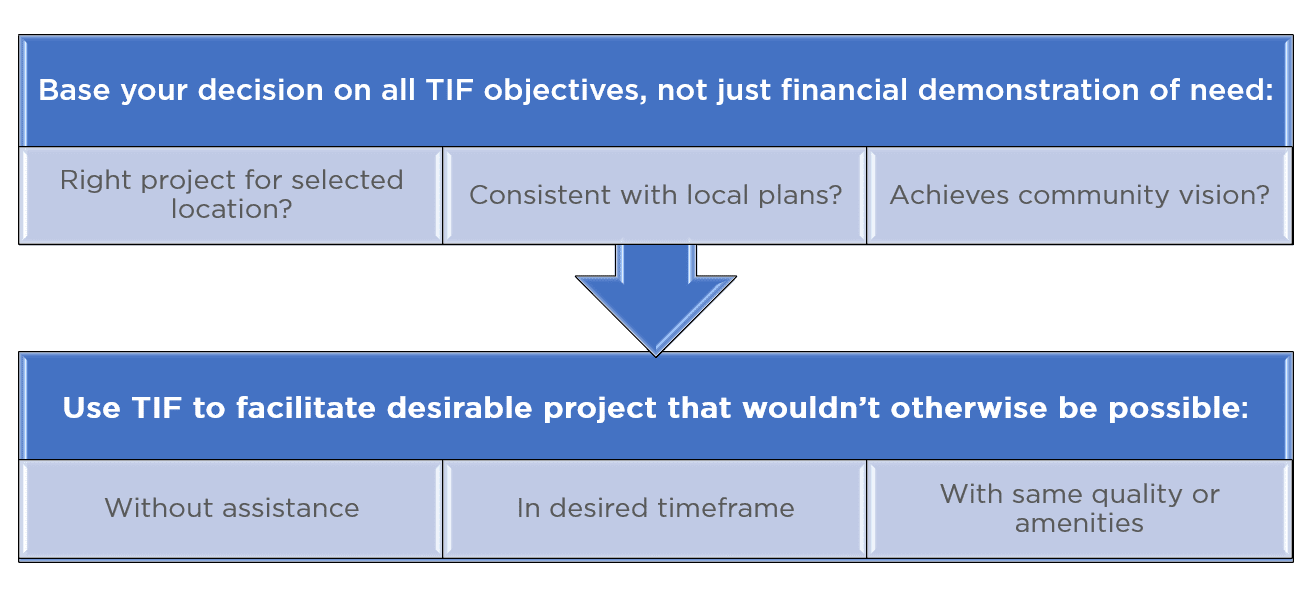

Satisfying the “But For” Test

Whether legally required or not, municipalities should strive to view tax increment financing through the lens of the “but for” test, which helps verify that, in the opinion of the municipality, the development or redevelopment would not be expected to occur solely through private investment within the foreseeable future but for the use of TIF assistance.

Common rationales to support the “but for” test include contaminated land, structurally substandard buildings, extraordinary costs to bring a site to a buildable standard, increased construction and borrowing costs, high infrastructure costs, below average market rents, or municipal requirements that impose additional costs (i.e., requiring a development to construct public infrastructure).

Analyzing a project for a financial gap helps to determine the amount of TIF assistance needed to complete a project and provide a reasonable return on investment to the developer. Best practices for identifying a financial gap include requiring submittal of a development budget, operating proforma, financing assumptions, cash flow projections with and without TIF support, and seeking an independent review of the development financials that substantiates the necessity of TIF assistance (pro forma analysis). This is most appropriate for income generating projects & real estate transactions, but more difficult for owner-occupied corporate initiatives.

When an in-depth review isn’t practical or desired, another approach is to tie TIF assistance to specific extraordinary costs. Extraordinary costs are costs over and above what a typical development would encounter. These costs could ultimately be driven by circumstances, conditions, and restrictive regulations beyond the control of the proposed development (i.e., environmental remediation, asbestos abatement, lead remediation, demolition, sustainability features, infrastructure, higher than normal architectural standards, etc.).

A thorough proforma review is basic aspect of completing a portfolio of documentation that objectively demonstrates the need for TIF assistance that should help to avoid challenges to the qualifying basis for establishing a TID and offering public assistance. Undertaking this level of diligence will also build equity with overlying taxing jurisdictions that are de facto partners in using TIF.

Mitigating Risk

A recommended best practice early in the design of a district that can mitigate risk is obtaining input from assessors on projected incremental values of projects. Construction cost is often a poor predictor of taxable value. When forecasting tax increment, it is important not to rely solely on economic appreciation to demonstrate a project can support its costs.

The spectrum of public assistance using TIF ranges from the pay-as-you-go approach (less risk) to municipal-funded assistance (more risk). A pay-as-you-go, or developer funded TID, is evidenced by a contractual agreement to remit a portion of the tax increment generated by a project to the developer to pay for specific development costs incurred. If the increment generated is not sufficient to pay the maximum agreed-upon amount, the municipality has no obligation to cover the shortfall.

If the project costs are funded by the municipality, ensure taxpayers are protected through minimum valuation or debt service guarantees, and other forms of security such as a letter of credit, (springing) special assessment, or a mortgage or other security interest on the TID project or other developer holdings. It is also important to tie municipal funding to specific construction or valuation milestones being met before funds are disbursed. In many cases, TIF assistance may be delivered through a combination of municipal funding and pay-as-you-go incentives.

A look back analysis provides an opportunity to review the total development cost and return on investment upon project stabilization, a sale (or a deemed sale, typically assumed at ten years) or other agreed on point or points in time. A lookback analysis incorporated into a developer agreement provides an opportunity for the municipality to adjust incentives, and to potentially share in a project’s returns over a pre-determined profitability level. The profitability metric, the documentation required to verify the profitability metric, and methodology used for the lookback analysis should all be explicitly described in the developer agreement.

TIF, at its core, is a partnership with all taxing jurisdictions to encourage both redevelopment and new development opportunities. Following these best practices can help ensure communities are creating quality districts that support projected costs and mitigate risk to taxpayers. Contact an Ehlers Municipal Advisor to assist you with evaluating options for using TIF in your community or analyzing any existing districts you may already have established.

Required Disclosures: Please Read

Ehlers is the joint marketing name of the following affiliated businesses (collectively, the “Affiliates”): Ehlers & Associates, Inc. (“EA”), a municipal advisor registered with the Municipal Securities Rulemaking Board (“MSRB”) and the Securities and Exchange Commission (“SEC”); Ehlers Investment Partners, LLC (“EIP”), an investment adviser registered with the SEC; and Bond Trust Services Corporation (“BTS”), holder of a limited banking charter issued by the State of Minnesota.

This communication does not constitute an offer or solicitation for the purchase or sale of any investment (including without limitation, any municipal financial product, municipal security, or other security) or agreement with respect to any investment strategy or program. This communication is offered without charge to clients, friends, and prospective clients of the Affiliates as a source of general information about the services Ehlers provides. This communication is neither advice nor a recommendation by any Affiliate to any person with respect to any municipal financial product, municipal security, or other security, as such terms are defined pursuant to Section 15B of the Exchange Act of 1934 and rules of the MSRB. This communication does not constitute investment advice by any Affiliate that purports to meet the objectives or needs of any person pursuant to the Investment Advisers Act of 1940 or applicable state law. In providing this information, The Affiliates are not acting as an advisor to you and do not owe you a fiduciary duty pursuant to Section 15B of the Securities Exchange Act of 1934. You should discuss the information contained herein with any and all internal or external advisors and experts you deem appropriate before acting on the information.