Key Financial Indicators

E-Quarterly Newsletter - March 2023

By Dan Tienter, Municipal Advisor

Turning Numbers Into Knowledge

To quote the philosopher Plato: “A good decision is based on knowledge and not on numbers.” In defense of numbers, we might amend the statement slightly and say, “A good decision should be based on more than basic numbers.” So, how do public organizations use their wealth of numbers to gain insight into and improve the financial health of their communities? The short answer is this: Key Financial Indicators (KFIs), or metrics that track, measure, and analyze the financial profile of a local government.

Generally, local governments use KFIs to inform the budget development process, guide long-term financial planning and support public policy discussions. They also provide for more meaningful comparisons with peer communities as they often take the form of ratios, which can control for certain factors, such as population (e.g., debt per capita) and size of tax base.

When developing KFIs, public entities should consider data sources and collection frequency. The financial data should be both reliable (consistency of measurement) and valid (accuracy of measurement). KFIs may be cross-sectional (i.e., point-in-time) or longitudinal (i.e., over a longer period) in nature, but it’s generally best practice to employ KFIs that analyze performance over a three- to five-year period to discern any meaningful trends. On occasion, even longer periods may be useful to address outliers or unusual data.

While this task may seem a bit daunting, there are several generally accepted KFIs available to help organizations manage liquidity and control debt, among other areas. By leveraging existing financial data, you can easily turn opaque information into transparent tools to more effectively manage daily operations and secure long-term financial health.

Managing Liquidity

Liquidity typically refers to the availability of cash for an organization to support required expenditures. The revenue cycle for most local governments can be best described as “lumpy,” with large receipts at the point of tax collection and state aids or shared revenues. Expenditures carry a higher frequency, with payroll and other cash outflows occurring far more regularly than receipts. Depending upon the type of fund and its cash flows, it’s important to adopt specific liquidity standards and monitor them as KFIs.

Fund Balance Requirements

Fund balance can be considered the total amount of accumulated resources since the inception of your community. From an accounting perspective, it’s assets net of liabilities. Fund balance is comprised of categories that speak to its composition, along with legal or other restrictions placed on those balances. Some are restricted legally by a third party, while others are restricted by action of a governing body. When considering the liquidity resources of your entity, assigned and unassigned fund balance represent what is generally available, with unassigned providing the highest level of availability. When considering appropriate fund balance amounts and the associated KFI, consider the composition of total fund balances and the cash flows for the respective fund.

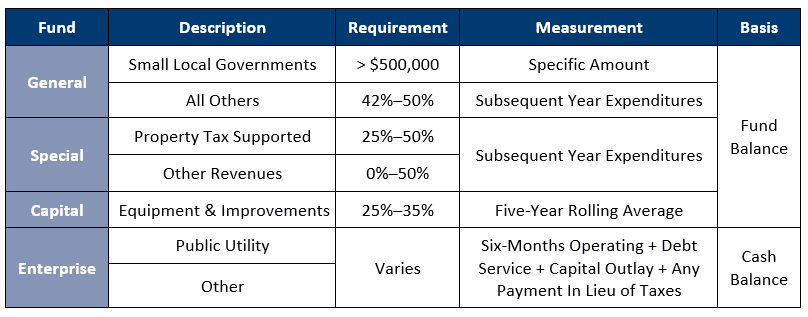

Since most local governments fund their operations primarily with property taxes, which are typically disbursed semi-annually, the General Fund should maintain an unassigned balance of 35% to 50% of expenditures planned for the subsequent year. Smaller communities may wish to target a dollar amount, rather than a percentage, as even a reasonably sized percentage may not be sufficient in absolute dollar terms. Enterprise funds should more specifically target cash balances. The goal here is to maintain sufficient cash to mitigate the risk that revenues could be interrupted, or materially diminished (i.e., loss of a large tax- or rate-payer). We often recommend using a figure termed “days cash on hand.” This tells you how many days of operations can be funded from available cash, understanding that you may delay or defer certain activities, such as capital projects. The following table summarizes typical fund and cash balance ranges by fund type and activity:

Like any good plan of action, public entities should regularly review KFIs both to gauge financial health and identify any trends. When it comes to fund balances and cash positions, an increasing or stable trend tends to indicate stronger financial performance and appropriate budgeting practices, while a decreasing or erratic trend may indicate the opposite. By identifying these patterns early, you can respond more thoughtfully to protect your community’s financial health and inspire confidence in your organization.

Controlling Leverage

Leverage generally refers to the outstanding and planned use of debt to support community needs. There are two primary types of debt obligations 1) general, or property tax-supported, obligations and 2) revenue, or self-supporting, obligations. Depending upon the fund and obligation type, it makes good sense to monitor at least two KFIs – debt per capita and debt service coverage ratios.

Debt Ratios

For general obligations, the most common KFIs tend to be debt per capita, which is calculated as…

Total Principal Amount of Outstanding Property Tax-Supported Debt

Population

…along with debt as a percentage of estimated market value.

Total Principal Amount of Outstanding Property Tax-Supported Debt

Estimated Market Value

These ratios may be specific to a single unit of government or include overlapping jurisdictions, such as a school district, to better understand overall debt obligations of a particular area. Often, public organizations attempt to remain below a certain amount of debt per capita (i.e., less than $4,000) as a more nuanced measurement than their legal debt limit. It’s best to use both debt per capita and as a percent of market value, especially when reviewing trends, as the characteristics of your community will change over time. This also allows for better comparative peer analysis, because you can better contrast with other growth communities or those that have transitioned more towards a more mature phase. When considering these ratios, be sure to exclude general obligation debt that is supported by other revenues, such as utility revenues.

With revenue obligations and enterprise funds, it’s important to consider a debt service coverage ratio, which is calculated as…

Available Net Revenue

Total Annual Principal and Interest Payments

Think of net revenue as cash available to pay debt service, or revenues less operating expenses net of non-cash items like depreciation and amortization. Generally, enterprise funds with debt service coverage ratios below 1.15 tend to be unable to build the meaningful cash reserves needed to fund finance future capital needs, whereas those with ratios of 1.25 and above tend to be able to support all cash outflows inclusive of debt service costs. Generally, enterprise funds with debt service coverage ratios above 1.50 are in a good financial position. If coverage is declining over time, you should consider adjusting rates and charges to stabilize revenues or identify cost savings.

Like fund balance requirements, be sure to review the trend and context of your debt service ratios regularly. For example, a consistently increasing debt per capita may point to unsustainable debt levels and lead to credit deterioration. Conversely, in situations such as a rapidly growing community requiring significant investments, increasing debt may be necessary and prudent.

By creating, regularly monitoring, and updating these and other KFIs, public entities can turn numbers into greater knowledge about their organization and its financial health. Through this knowledge and the power it provides (Schoolhouse Rock, anyone?!), organizations can improve the budgeting process, enhance long-term planning, and better compare themselves to other communities, all while inspiring confidence and limiting reactivity relative to public process.

Required Disclosures: Please Read

Ehlers is the joint marketing name of the following affiliated businesses (collectively, the “Affiliates”): Ehlers & Associates, Inc. (“EA”), a municipal advisor registered with the Municipal Securities Rulemaking Board (“MSRB”) and the Securities and Exchange Commission (“SEC”); Ehlers Investment Partners, LLC (“EIP”), an investment adviser registered with the SEC; and Bond Trust Services Corporation (“BTS”), holder of a limited banking charter issued by the State of Minnesota.

This communication does not constitute an offer or solicitation for the purchase or sale of any investment (including without limitation, any municipal financial product, municipal security, or other security) or agreement with respect to any investment strategy or program. This communication is offered without charge to clients, friends, and prospective clients of the Affiliates as a source of general information about the services Ehlers provides. This communication is neither advice nor a recommendation by any Affiliate to any person with respect to any municipal financial product, municipal security, or other security, as such terms are defined pursuant to Section 15B of the Exchange Act of 1934 and rules of the MSRB. This communication does not constitute investment advice by any Affiliate that purports to meet the objectives or needs of any person pursuant to the Investment Advisers Act of 1940 or applicable state law. In providing this information, The Affiliates are not acting as an advisor to you and do not owe you a fiduciary duty pursuant to Section 15B of the Securities Exchange Act of 1934. You should discuss the information contained herein with any and all internal or external advisors and experts you deem appropriate before acting on the information.