Affordable Housing Blueprint

E-Quarterly Newsletter - December 2023

By Stacie Kvilvang, Senior Municipal Advisor

Navigating Minnesota’s .25% Sales Tax Legislation

In October 2023, the Minnesota State Legislature implemented a .25% sales tax within the 7-County Metropolitan Area to create a longer-term funding mechanism for the development and preservation of affordable housing. Revenues generated from the sales tax will be allocated to cities with populations greater than 10,000, and all Metropolitan Area counties. Initial funding will be delivered on July 20, 2024, and be followed by a second disbursement on December 26, 2024.

These new funding sources trigger many questions as to how they may be used, and perhaps more importantly, how to account for the funds and accurately fulfill any reporting requirements. The following offers a brief summary that highlights uses, income requirements, and reporting dates.

Use & Income

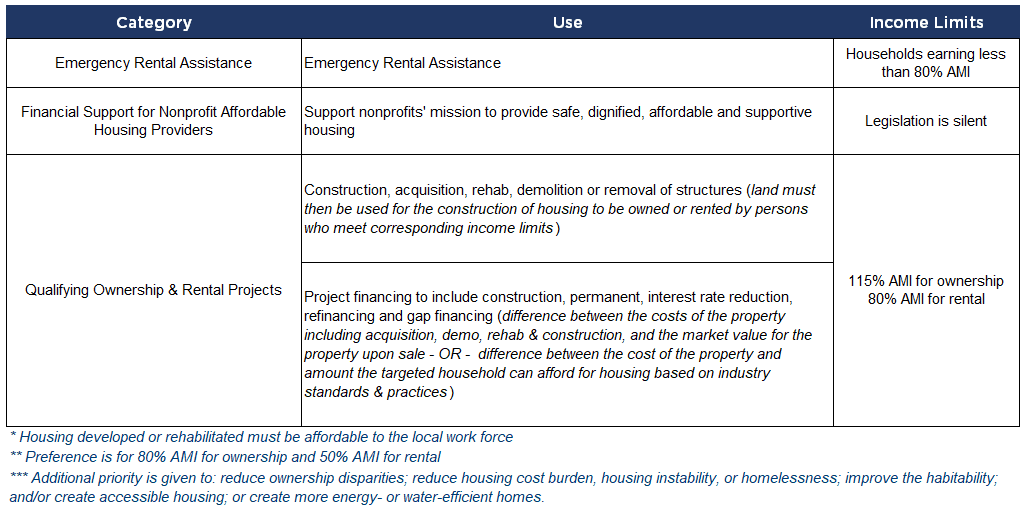

There are three qualifying categories and corresponding income limits for use of the new sales tax funds:

Although the legislation indicates a preference for lower Area Median Income (AMI) on projects and other priorities, there is no mandate stating that cities and counties must conform to it. That said, cities and counties do need to determine what is affordable to their local workforce. Many communities maintain single-family rehabilitation programs or are actively seeking resources to fund new initiatives. In practical terms, these new sales tax dollars could be leveraged for home ownership programs that may include new construction, rehabilitation, down payment assistance or even land bank programs. For rental projects, funds may be used to retain or reinvest in naturally occurring affordable housing or provide assistance for the construction or rehabilitation of mixed‑income or 100% affordable projects. It is important to note that multi-family projects with more than four units must include both (i) the greater of one unit or five percent of units accessible, and (ii) the greater of one unit or five percent of the units sensory‑accessible.

Administration & Reporting

Eligible municipalities should place this money in a separate fund and implement strong record-keeping procedures to track their use, as statute requires all received funds to be spent by December 31st of the fourth year. There is no prescribed method for tracking the use of funds, but depending on a public entity’s accounting system, it’s prudent to either:

- Establish a special revenue fund, and include separate projects within it to account for the funds by year and the amount expended by the required date (similar to TIF funds tracking) – OR –

- Set up a special revenue fund for each year’s allocation to help ensure funds are expended by the required date (similar to grant funds tracking)

It is also important for cities and counties to develop a tracking system that maintains data for each specific project on which funds were spent, so they can accurately prepare and submit required reporting to MN Housing on December 1st of every year (begins in 2025). Below are the required reporting dates and related actions:

As item 4 in the above table demonstrates, if a city or county is unable to expend the funds within the three-year window allotted, but can demonstrate to MN Housing that the delay was a result of factors beyond its control, they can then be transferred to an Affordable Housing Trust Fund (AHTF) and will be considered expended on a qualifying project (funds must still be spent on a project or household that meets the use and income requirements). That said, it makes good sense for municipalities that don’t have an AHTF to wait to establish one until there is more guidance from MN Housing on its requirements to demonstrate inability to expend funds within the allotted time period.

If your community has questions regarding this new legislation or needs assistance navigating the approved uses, record-keeping, reporting requirements, AHTF establishment process, or project planning and management, please don’t hesitate to contact your Ehlers Municipal Advisor. We’re happy to help!

Important Disclosures:

Ehlers is the joint marketing name of the following affiliated businesses (collectively, the “Affiliates”): Ehlers & Associates, Inc. (“EA”), a municipal advisor registered with the Municipal Securities Rulemaking Board (“MSRB”) and the Securities and Exchange Commission (“SEC”); Ehlers Investment Partners, LLC (“EIP”), an SEC registered investment adviser; and Bond Trust Services Corporation (“BTS”), holder of a limited banking charter issued by the State of Minnesota.

Where an activity requires registration as a municipal advisor pursuant to Section 15B of the Exchange Act of 1934 (Financial Management Planning and Debt Issuance & Management), such activity is or will be performed by EA; where an activity requires registration as an investment adviser pursuant to the Investment Advisers Act of 1940 (Investments and Treasury Management), such activity is or will be performed by EIP; and where an activity requires licensing as a bank pursuant to applicable state law (paying agent services shown under Debt Issuance & Management), such activity is or will be performed by BTS. Activities not requiring registration may be performed by any Affiliate.

This communication does not constitute an offer or solicitation for the purchase or sale of any investment (including without limitation, any municipal financial product, municipal security, or other security) or agreement with respect to any investment strategy or program. This communication is offered without charge to clients, friends, and prospective clients of the Affiliates as a source of general information about the services Ehlers provides. This communication is neither advice nor a recommendation by any Affiliate to any person with respect to any municipal financial product, municipal security, or other security, as such terms are defined pursuant to Section 15B of the Exchange Act of 1934 and rules of the MSRB. This communication does not constitute investment advice by any Affiliate that purports to meet the objectives or needs of any person pursuant to the Investment Advisers Act of 1940 or applicable state law.