2023 Wisconsin Act 12

E-Quarterly Newsletter - December 2023

By Todd Taves, Senior Municipal Advisor | Managing Director

Levy Limit & Tax Incremental District Impacts

The recently enacted local government funding legislation (2023 Wisconsin Act 12) imposes significant changes to the shared revenue program, eliminates the personal property tax, and creates an innovation fund to encourage consolidation and transfer of services to promote cost savings. However, as a late-session compromise to gain the support needed to pass this legislation, Act 12 was amended to include provisions for how construction in tax incremental districts (TIDs) will be treated under levy limits that will impact newly created TIDs beginning in 2024. Here’s what Wisconsin municipalities need to know:

Existing TIDs, and those created through September 30, 2024, are not impacted. Municipalities will continue to receive levy limit adjustments under the provisions of the former statute for those TIDs. That means:

- On an annual basis, your levy limit is increased by a percentage equal to 100% of the amount of net new construction that occurred in the TID in the prior year (Net new construction is defined as the value of improvements added, less the value of any improvements removed).

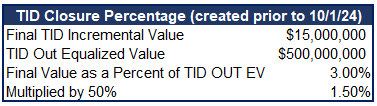

- At the time of TID closure, you are afforded a one-time levy limit increase – an adjustment equal to one-half of the percentage of the final incremental value of the TID divided by that same year’s TID OUT value.

- In the event of a subtraction of territory, you’re provided a similar one-time levy limit increase based on the value of the removed territory.

TIDs created on or after October 1, 2024, are subject to a reduced levy limit benefit:

- Instead of 100% of net new construction, your annual adjustment will be reduced to 90% of new (not net new) construction.

- In certain cases where demolition in a TID takes place (i.e., redevelopment projects), the fact that removed improvements won’t reduce the adjustment will offer some benefit.

- In general, municipalities will see a slightly diminished annual levy limit benefit from TID development compared to what the prior law provided.

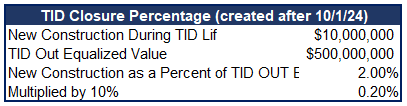

- At TID closure, your one-time adjustment will be reduced from 50% of final incremental value to 10% of the new construction that occurred from the time of TID creation through its closure (the 10% not received as it occurred). This is the most impactful change under the new legislation, as it will significantly diminish the TID closure adjustment benefit. In addition to the overall percentage reduction, basing the closure on new construction instead of final incremental value means that you won’t receive any benefit from economic appreciation that may occur during the life of the TID. TIDs will also receive an adjustment on subtraction of territory using this new methodology.

Below are illustrations of the allowable levy increase for TID closures for TIDs created prior to 10/1/2024 and after 10/1/2024.

- The new law does create an incentive for early TID closure. If a TID is closed within 75% or less of its expected life, the 10% closure adjustment is increased to 25%. Using the illustration above, the percentage increases from 0.20% to 0.50%. The Joint Review Board determines the TIDs estimated life, a number which may not necessarily be the maximum permitted statutory life. Pending guidance from the Department of Revenue, it’s likely the way this provision will be administered is by documenting the projected closure year in the Joint Review Board’s TID approving resolution. The projected closure year should be based on the cash flow projections included in the Project Plan as part of the economic feasibility study. For example: to qualify for this early closure benefit, a 20-year mixed use TID with a projected closure in 12 years would need to close by the end of year nine.

In the near term, you should assess whether creating a TID prior to October 1, 2024, to receive the benefit of the prior law’s more generous provisions makes sense for your community. It’s perhaps more important, however, to recognize that there are numerous factors – outside this legislative change – to consider when determining the best time to create a new TID. Be sure to consult with your municipal and economic development advisors to determine the best course of action.

Important Disclosures:

Ehlers is the joint marketing name of the following affiliated businesses (collectively, the “Affiliates”): Ehlers & Associates, Inc. (“EA”), a municipal advisor registered with the Municipal Securities Rulemaking Board (“MSRB”) and the Securities and Exchange Commission (“SEC”); Ehlers Investment Partners, LLC (“EIP”), an SEC registered investment adviser; and Bond Trust Services Corporation (“BTS”), holder of a limited banking charter issued by the State of Minnesota.

Where an activity requires registration as a municipal advisor pursuant to Section 15B of the Exchange Act of 1934 (Financial Management Planning and Debt Issuance & Management), such activity is or will be performed by EA; where an activity requires registration as an investment adviser pursuant to the Investment Advisers Act of 1940 (Investments and Treasury Management), such activity is or will be performed by EIP; and where an activity requires licensing as a bank pursuant to applicable state law (paying agent services shown under Debt Issuance & Management), such activity is or will be performed by BTS. Activities not requiring registration may be performed by any Affiliate.

This communication does not constitute an offer or solicitation for the purchase or sale of any investment (including without limitation, any municipal financial product, municipal security, or other security) or agreement with respect to any investment strategy or program. This communication is offered without charge to clients, friends, and prospective clients of the Affiliates as a source of general information about the services Ehlers provides. This communication is neither advice nor a recommendation by any Affiliate to any person with respect to any municipal financial product, municipal security, or other security, as such terms are defined pursuant to Section 15B of the Exchange Act of 1934 and rules of the MSRB. This communication does not constitute investment advice by any Affiliate that purports to meet the objectives or needs of any person pursuant to the Investment Advisers Act of 1940 or applicable state law.